July 16, 2025 – China’s financial system grew by a sturdy 5.2% in Q2 2025, showcasing resilience in opposition to U.S. tariffs and international commerce tensions. Nonetheless, beneath this headline energy lies a stark actuality for a lot of employees: shrinking wages, cost delays, and a reliance on facet hustles to make ends meet. This dual-speed financial system—buoyed by export-driven industries however strained by weak home consumption—reveals structural vulnerabilities that threaten long-term development. Drawing from current reviews and private tales, this evaluation explores the challenges confronted by Chinese language employees, the coverage missteps driving these points, and the broader implications for China’s financial trajectory.

The Floor: A Resilient Export Machine

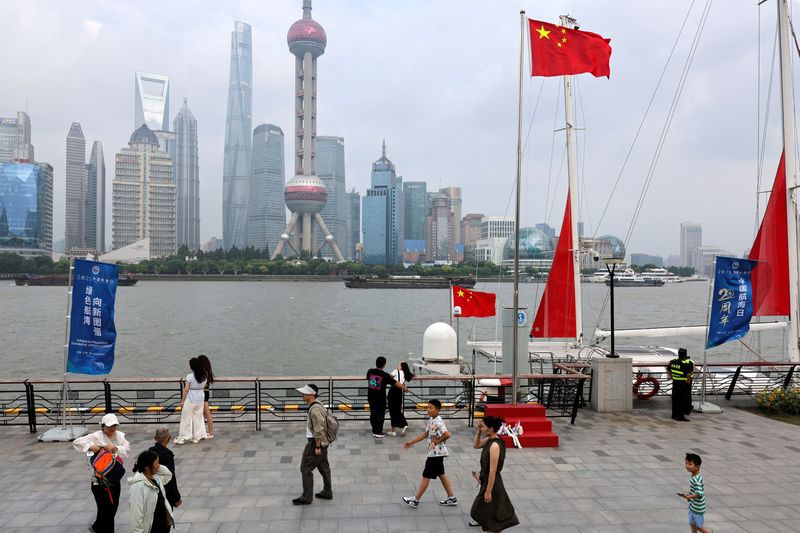

China’s 5.2% GDP development in Q2 2025, pushed by its export-heavy mannequin, has defied expectations amid U.S. tariffs, together with President Trump’s current 25% tariffs on Canada and Mexico and 10% on Chinese language imports. Exports of high-tech merchandise like electrical autos, lithium batteries, and photo voltaic panels surged 61.6% year-on-year within the first half of 2025, contributing to China’s function as a worldwide financial engine, accounting for one-third of world development. The Shenzhen Inventory Change reported a 12.3% rise in working revenues and 10.54% in web earnings for listed corporations in Q2, signaling company resilience in export-driven sectors.

This development stems from a long time of strategic financial planning, with China’s GDP averaging over 9% yearly since 1978, lifting 800 million folks out of poverty. Insurance policies favoring manufacturing and infrastructure, coupled with stimulus measures like rate of interest cuts and loosened dwelling buy restrictions since Evergrande’s 2021 collapse, have saved factories buzzing. But, this deal with output over demand masks rising cracks within the financial basis.

The Actuality: Pay Cuts and Facet Hustles

Beneath the headline figures, Chinese language employees face mounting monetary pressure:

- Wage Reductions: Zhang Jinming, a 30-year-old state agency worker in actual property, noticed his wage lower by 24%, from 5,500 yuan ($765) to 4,200 yuan ($585) month-to-month. To manage, he delivers meals three hours nightly and on weekends, incomes 60–70 yuan per night. “There’s simply no different manner,” he informed Reuters, noting elevated workloads after colleagues resigned.

- Job Losses and Unpaid Wages: Huang Tingting, a 20-year-old waitress in Jiangsu, give up her job in June 2025 after her restaurant mandated 4 unpaid go away days month-to-month as a result of plummeting enterprise throughout U.S.-China commerce tensions. Frank Huang, a 28-year-old instructor in Chongzuo, reported two-to-three-month delays in his 5,000-yuan wage, counting on household help to outlive.

- Facet Hustles as Survival: The gig financial system, using over 200 million, is saturated, with cities warning of ride-hailing oversaturation. In Hunan, even civil servants, as soon as safe in “iron rice bowl” jobs, are permitted to take facet jobs like driving or teaching to offset wage cuts, reflecting fiscal pressure as authorities income development fell from 6.4% in 2023 to 1.3% in 2024.

These tales spotlight a broader pattern: falling earnings and wages are shrinking tax revenues, forcing state employers and native governments to chop prices, exacerbating monetary pressures on employees.

Structural Points: A Twin-Pace Economic system

Economists describe China as a “dual-speed financial system,” with robust industrial output however weak family consumption. Max Zenglein of the Convention Board of Asia notes that low profitability and deflationary pressures stem from overcapacity in manufacturing and know-how sectors. Key points embrace:

- Fee Delays and Liquidity Stress: Accounts receivable in autos and electronics—key export sectors—rose 16.6% and 11.2% year-over-year via Could 2025, outpacing the 9% business common. Utilities like water and fuel noticed overdue funds climb 17.1% and 11.1%, reflecting money circulation points amongst indebted native governments supporting tariff-hit factories. Minxiong Liao of GlobalData.TS Lombard APAC warns this prioritization of output over demand will sluggish development in these “champion sectors.”

- Manufacturing facility-Gate Deflation: Fierce competitors for international demand, intensified by commerce tensions, has crimped industrial earnings, fueling deflation on the producer degree regardless of rising export volumes. This squeezes firms, resulting in cost-cutting measures like wage reductions.

- Non-Performing Loans: Banks face surging unhealthy loans as authorities push lending to prop up the financial system, straining the monetary system.

- Weak Consumption: Beijing’s pledge to spice up family spending has faltered. Customers, dealing with revenue uncertainty, are deferring purchases, risking persistent deflation. Retail gross sales, whereas up 10% annualized via mid-2025, lag total GDP development, underscoring consumption’s weak spot.

Coverage Missteps and the Export Bias

China’s lopsided development is rooted in insurance policies favoring exporters over home customers. Economists have lengthy urged Beijing to redirect help to sectors like training and healthcare or bolster welfare to stimulate family spending. As a substitute, the federal government has doubled down on manufacturing, with stimulus measures like December 2024’s shift to a “reasonably free” financial coverage—the primary because the international monetary disaster. This focus exacerbates overcapacity, driving down earnings and wages whereas neglecting home demand.

The commerce struggle, significantly Trump’s tariffs, has intensified these challenges. Whereas exports stay robust, U.S. insurance policies just like the resumed sale of Nvidia’s H20 AI chips purpose to maintain China depending on American tech, limiting its self-reliance. Home corporations face fierce competitors, with international firms like IBM scaling again as native manufacturers undertake low-price methods to seize market share.

Human Affect: A Technology Beneath Strain

The financial pressure is reshaping lives:

- Youth Unemployment: City youth unemployment (ages 16–24) hit 17.1% in July 2024, with 11.79 million college graduates dealing with job shortage. Many, like Olivia Lin, a former Shenzhen civil servant, wrestle to seek out work after layoffs, along with her job search yielding no interviews in a month.

- Underemployment: Sociologist Yao Lu estimates 25% of faculty graduates aged 23–35 are in jobs under their {qualifications}, incomes low salaries and contributing much less in taxes.

- Social Shifts: The stigma round unemployment is fading, with some youth embracing “mendacity flat” or inventive facet hustles like promoting handicrafts on-line, as steered by influencer He. Nonetheless, this displays a broader internalization of discontent amid restricted alternatives.

Future Dangers and Coverage Suggestions

With out reform, China dangers a slowdown within the second half of 2025. Economists warn that persistent deflation might additional dampen consumption, whereas overcapacity in manufacturing might result in slower development in key sectors. Potential options embrace:

- Boosting Home Consumption: Rising welfare, healthcare, and training spending might stabilize family incomes and encourage spending.

- Lowering Overcapacity: Scaling again manufacturing subsidies and specializing in demand-driven development might ease deflationary pressures.

- Labor Market Reforms: Addressing the abilities mismatch, as vocational graduates are ill-equipped for high-demand roles like digital expertise or caregiving, might cut back underemployment.

- International Cooperation: Balancing commerce tensions via selective decoupling and resilient provide chains, as steered by the Atlantic Council, might mitigate exterior shocks.

China’s 5.2% development masks a fragile underbelly of pay cuts, cost delays, and a gig financial system stretched to its limits. Staff like Zhang Jinming and Huang Tingting embody the human price of an export-driven mannequin that prioritizes output over home well-being. As Beijing grapples with deflation and commerce pressures, redirecting focus to family consumption and structural reforms is crucial to sustaining development. For now, the resilience of China’s financial system is overshadowed by the facet hustles and sacrifices of its folks. Observe updates on Reuters or The Straits Times for the most recent developments.