As world motorbike gross sales traits 2026, motorbike business strain 2025, US motorbike market decline, KTM gross sales restoration, and electrical motorbike development dominate searches amid financial uncertainty, new experiences reveal that seemingly steady or flatlining gross sales figures are hiding widespread monetary pressure throughout the sector, with dealership closures and producer restructuring signaling harder instances forward.

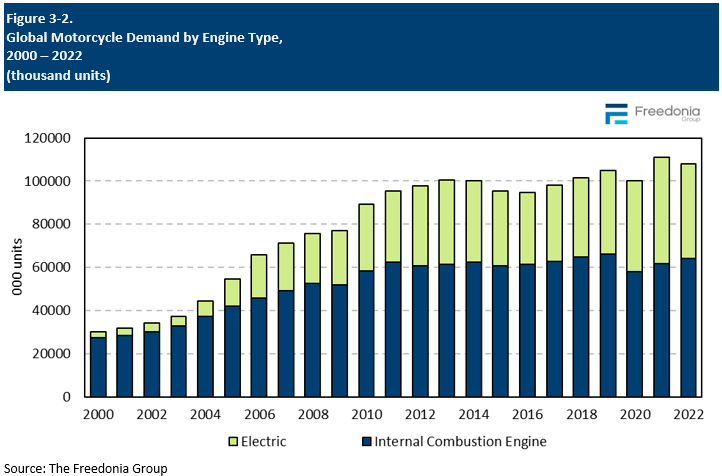

The motorbike business entered 2026 on shaky floor after a turbulent 2025, the place U.S. gross sales dropped sharply by 9.2% year-to-date via October, marking one of many steepest declines for the reason that 2008 monetary disaster. Globally, whereas rising markets stored general volumes round 60 million items, mature markets like North America and Europe confronted contraction, overproduction fallout, and rising stock prices.

Dealerships bore the brunt, with almost 120 U.S. retailers closing completely since early 2025, burdened by costly floorplan financing on unsold bikes lingering from post-pandemic overstock.

Empty showrooms and quiet service bays grew to become widespread, as excessive rates of interest deterred patrons and tightened credit score led to extra repossessions.

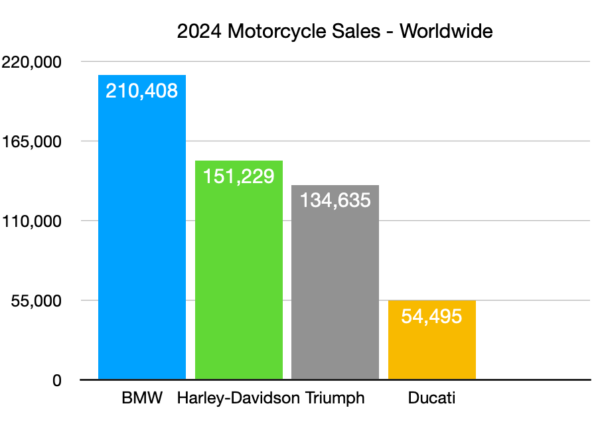

Main manufacturers felt the pinch in a different way. Premium gamers like Harley-Davidson noticed vital income drops of their core U.S. market on account of discretionary spending cuts and financial uncertainty. KTM, after manufacturing halts and restructuring, reported over 100,000 items offered within the first half of 2025 however nonetheless lagged prior years, although Bajaj Auto’s main funding helped stabilize operations and restart 2026 mannequin manufacturing.

In distinction, Kawasaki surged to the highest U.S. spot, overtaking Honda and Harley with inexpensive, dependable fashions interesting in a cost-conscious setting. Quantity leaders like Honda maintained world dominance via robust Asian demand.

Gross sales charts from 2025 spotlight the divide: sharp drops in Western markets offset by stability in Asia, creating an phantasm of flatlining when aggregated globally.

Trade specialists attribute the hidden strain to lingering post-COVID overproduction, stricter emissions regs (like Euro 5+ in Europe), and shifting shopper priorities towards affordability over premium options. “We’re seeing a bifurcation—strong commuter demand in rising markets versus discretionary pullback within the West,” famous one analyst from MotorCyclesData.

Public reactions on boards and social media replicate frustration, with riders debating model survival and searching offers on leftover 2025 fashions. U.S. fans fear about fewer dealership choices for service and components.

For American readers, this disaster hits near house. The U.S. powersports sector helps hundreds of jobs in manufacturing, retail, and tourism tied to using tradition. Declines might ripple into native economies, from decreased aftermarket spending to fewer rally occasions. But, alternatives emerge: deeper reductions on new bikes, development in used markets, and incentives for electrical fashions as gasoline prices fluctuate.

Electrical bikes supply a shiny spot, with city charging infrastructure increasing and types pushing sustainable choices to satisfy regulatory pressures.

Analysts predict reasonable restoration in 2026, with 4-6% world CAGR via 2030, pushed by Asian quantity and EV adoption.

Harley-Davidson faces ongoing challenges with softer demand for its iconic cruisers, prompting strategic shifts towards extra accessible entry-level bikes.

Sellers advise defending money stream, leaning inventories, and specializing in service income amid muted development forecasts.

The business is not collapsing, however flatlining headlines obscure actual ache factors like closures and debt. Adaptation via electrification, worth pricing, and regional focus will separate survivors.

In abstract, with motorbike gross sales traits 2026 pointing to stabilization, motorbike business strain 2025 easing slowly, US motorbike market decline bottoming out, KTM gross sales restoration gaining traction, and electrical motorbike development accelerating, the sector eyes cautious optimism.

By Mark Smith

Observe us on X @realnewshubs and subscribe for push notifications