Washington, D.C. – August 28, 2025, The U.S. Securities and Exchange Commission (SEC) is facing a flood of public comments and proposals aimed at overhauling its complex executive compensation disclosure rules, following a high-profile roundtable that exposed widespread frustration with the current regime. SEC Chair Paul Atkins, who took office in April 2025, has described the framework as a “Frankenstein patchwork of rules,” a metaphor echoed by commissioners and stakeholders who argue the requirements have become overly burdensome, confusing, and disconnected from investor needs. Since the roundtable on June 26, the agency has received dozens of comment letters from public companies, investors, legal experts, and advisory firms, urging simplification and a focus on materiality amid calls for potential rulemaking by year’s end.

The disclosures, governed primarily by Item 402 of Regulation S-K, originated with the 1992 introduction of the Summary Compensation Table to make pay “easily comprehensible.” However, subsequent additions—particularly those mandated by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act—have layered on complexity. These include the CEO pay ratio, pay-versus-performance (PVP) rules, clawback policies, and detailed perquisite reporting, which critics say prioritize prescriptive details over useful insights for investors. Atkins, in his opening remarks at the roundtable, likened the rules to the monster from Mary Shelley’s novel, noting their “volume and complexity” scare even seasoned law firm associates reviewing proxy statements. Commissioners Hester Peirce and Mark T. Uyeda reinforced this, with Peirce questioning whether perk disclosures—like corporate jet usage or housing allowances—serve investors or merely “entertain the onlooker.”

The roundtable, held at SEC headquarters, featured panels with issuers, compensation consultants, institutional investors, and advisors discussing the rules’ effectiveness. Key takeaways included a consensus on streamlining: Panelists advocated for principles-based approaches over rigid prescriptions, especially for smaller companies facing high compliance costs. One consultant analogized the disclosures to “rum raisin ice cream”—appealing to a niche audience but not the “reasonable investor” standard under federal securities laws. Investors, however, pushed back, emphasizing the need for transparency in areas like equity award lifecycles and excessive perks, citing a Glass Lewis survey where a majority expressed concerns over perquisites signaling broader pay issues.

A Deluge of Ideas: Public Comments Pour In

Since soliciting public input in advance of the roundtable, the SEC has been deluged with ideas for reform. Comment letters, available on the agency’s website, highlight specific pain points and proposals:

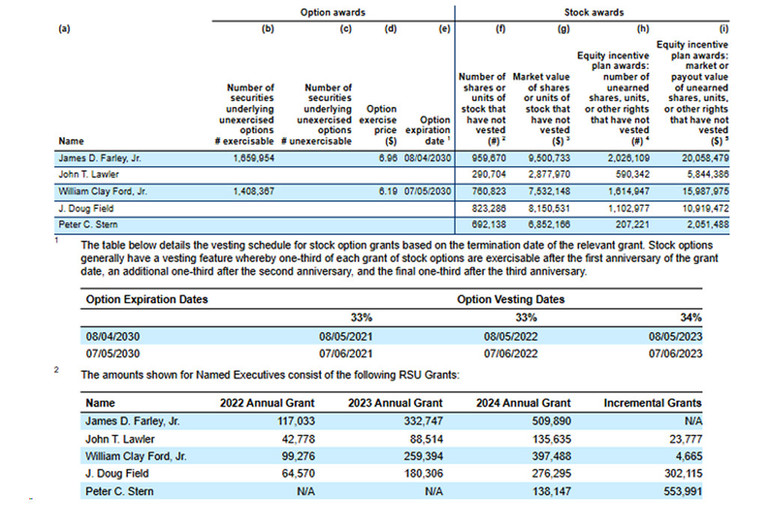

- Pay-Versus-Performance (PVP) Rule: Adopted in 2022 to implement Dodd-Frank Section 953(a), this requires a table linking executive pay to company performance over five years. Critics, including a letter from compensation firm Meridian Compensation Partners, called it “overly complex and costly,” suggesting a simplified four-column table focusing on CEO/CFO data and total shareholder return (TSR). Investors countered by requesting grant-by-grant equity breakdowns for better trend analysis.

- CEO Pay Ratio: Mandated by Dodd-Frank, this compares CEO pay to median employee compensation. A letter from an anonymous issuer noted it “does not provide accurate comparisons across industries” due to varying workforce structures, with little impact on investor decisions. Another from the Society for Corporate Governance argued it serves more as a “name and shame” tool than investor protection, increasing costs without benefits.

- Clawback Policies: Implemented in 2023, these require recovering incentive pay based on erroneous financials. Commenters like those from McDermott Will & Emery pointed to “lack of clarity” on accounting errors, with few companies triggering recoveries despite the rule’s scope. Proposals include narrowing triggers to intentional misconduct.

- Perquisites and Other Disclosures: Peirce questioned the utility of detailing minor perks, suggesting they fuel public curiosity rather than inform votes. A Fortune analysis echoed this, noting the rules’ evolution into a “makeover” candidate, while a Harvard Corporate Governance post advocated evaluating supplemental tables for post-employment pay.

Smaller issuers, like those in the Russell 2000, emphasized scaled disclosure, with one letter stating compliance burdens “drain resources from capital formation.” Overall, commenters urged a holistic review—the first since 2006—focusing on plain English, materiality, and cost-effectiveness to align with the SEC’s mission of investor protection, fair markets, and capital formation.

| Key Disclosure Rule | Year Adopted | Main Criticism | Proposed Reforms |

|---|---|---|---|

| Summary Compensation Table | 1992 | Overly detailed, hard to parse | Streamline for clarity; principles-based |

| Pay-Versus-Performance | 2022 | Complex tables; high costs | Simplify to core metrics; focus on CEO/CFO |

| CEO Pay Ratio | 2017 | Not comparable across firms; political | Repeal or scale for small caps |

| Clawback Policies | 2023 | Ambiguous triggers; low usage | Clarify errors; limit to fraud |

| Perquisites Reporting | 2006 | Satisfies curiosity, not investors | Raise de minimis threshold; focus on material perks |

Implications for Companies and Investors

The push for reform aligns with broader SEC efforts under Atkins to reduce regulatory burdens, including reviews of climate disclosures and cybersecurity rules. Public companies, facing proxy statement lengths exceeding 100 pages, welcome potential relief—especially mid- and small-caps where compliance diverts from core operations. A Carlton Fields analysis noted the roundtable’s “lively discussion” could lead to rulemaking by Q4 2025, potentially amending rules beyond Dodd-Frank mandates.

Investors and proxy advisors like Glass Lewis stress retaining key data for pay-for-performance alignment, warning against over-simplification. “Disclosures should educate, not obscure,” one panelist said. On X, legal experts debated the “Frankenstein” label, with @CorpGovWatch posting: “Atkins’ roundtable signals real change—time to bury the monster?” while skeptics worried about weakening transparency.

As the SEC digests comments—expected to continue through September—stakeholders anticipate proposed rules that balance utility with efficiency. For now, the deluge underscores a consensus: The patchwork needs mending to better serve the modern market.