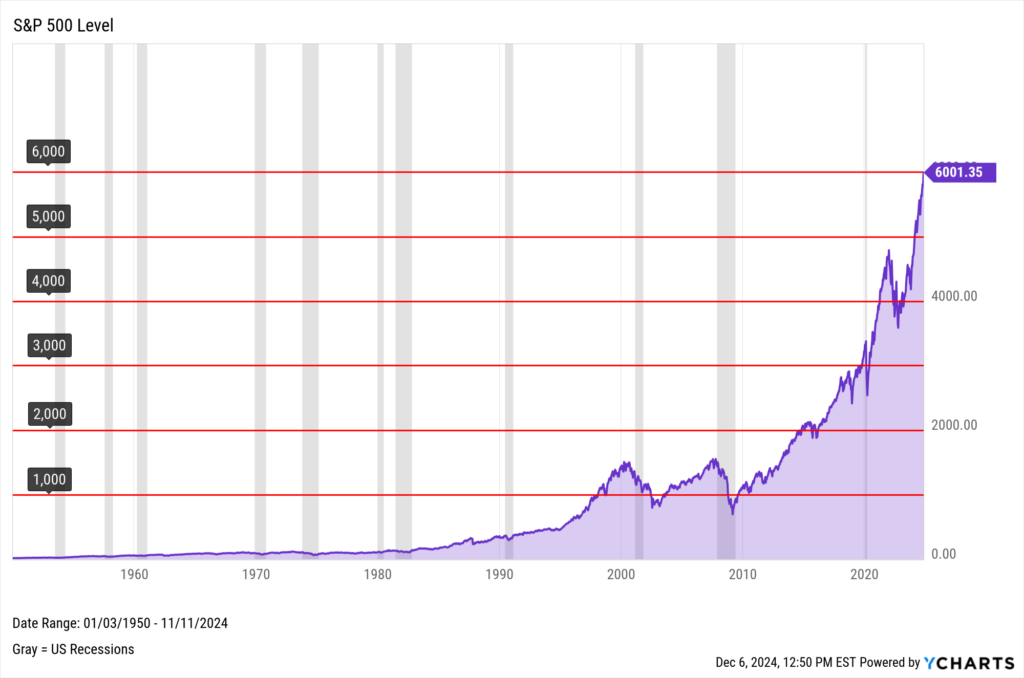

Bullish Finish: S&P 500 Eyes 7,000 Milestone as Investors Seek Strong Close to Stellar 2025 Rally

In a thrilling year-end push, the S&P 500 is eyeing the psychological 7,000 mark as investors hunt for an upbeat finish to a robust 2025, with the benchmark index hovering near record highs amid optimism over economic resilience and potential rate cuts. Trading around 6,906 as of December 29, the S&P 500 has surged nearly 18-19% year-to-date, fueled by AI-driven gains and a resilient U.S. economy.

The index closed at approximately 6,906 on December 29 after touching intraday highs near 6,945 earlier in the week, putting the coveted 7,000 level tantalizingly close with just one trading day left in 2025. Thin holiday volumes amplified swings, but the “Santa Claus rally”—typically the last five days of December and first two of January—has delivered, extending an eighth consecutive monthly gain for the S&P 500.

Driving the momentum: Cooling inflation, Federal Reserve rate cuts totaling 75 basis points in 2025 (bringing the benchmark to 3.50%-3.75%), and explosive growth in AI-related sectors. Tech-heavy Nasdaq has outperformed with 22% gains, while top performers like storage giants benefited from data center demand.

Analysts highlight elevated valuations—Shiller P/E near 40.7—as a caution, but earnings growth catching up to hype has sustained the rally. Institutional forecasts vary, with some like Wells Fargo eyeing 7,007 by end-2025 (now potentially for 2026), reflecting confidence in productivity boosts from AI.

For U.S. readers, this S&P 500 push toward 7,000 caps a banner year impacting retirement accounts, 401(k)s, and consumer confidence. Strong corporate buybacks (projected $1 trillion in 2025) and job market stability have supported spending, potentially easing everyday costs like groceries and fuel amid broader economic tailwinds.

As markets eye the final session on December 31, the S&P 500’s charge toward 7,000 underscores a historic bull run. Whether it crosses the threshold before year’s end remains uncertain amid light trading, but the trajectory signals sustained optimism heading into 2026.

By Mark Smith

Follow us on X @realnewshubs and subscribe for push notifications to stay locked on every US judge orders Kilmar Abrego Garcia’s release from ICE custody development!

Follow and subscribe to us for push notifications to never miss the latest updates.

S&P 500 7000 mark, S&P 500 year end 2025, stock market rally 2025, S&P 500 record highs, Wall Street bull market, AI stocks performance, Federal Reserve rate cuts, Santa Claus rally, S&P 500 valuation 2025, U.S. stock market news, Nasdaq gains 2025, investor optimism 2026, Shiller PE ratio, corporate earnings growth