Tough Year Closes Out: Toronto Housing Market 2025 Ends with Sharp Declines in Home Sales Prices and Lowest Activity in Decades

Toronto housing market 2025 wrapped up with significant home sales declines, average home prices drop, and the lowest sales volume in 25 years, as GTA real estate slowdown persists amid affordability gains and hopes for 2026 recovery trends.

The Greater Toronto Area (GTA) real estate scene limped into 2026 on a somber note. Home sales and prices both tumbled throughout 2025, capping a challenging year for buyers, sellers, and the broader market.

According to the Toronto Regional Real Estate Board (TRREB)’s latest report released January 7, 2026, December 2025 saw just 3,697 home sales—a drop of 8.9% from December 2024. New listings edged up slightly by 1.8% to 5,299, creating a more balanced but buyer-friendly environment.

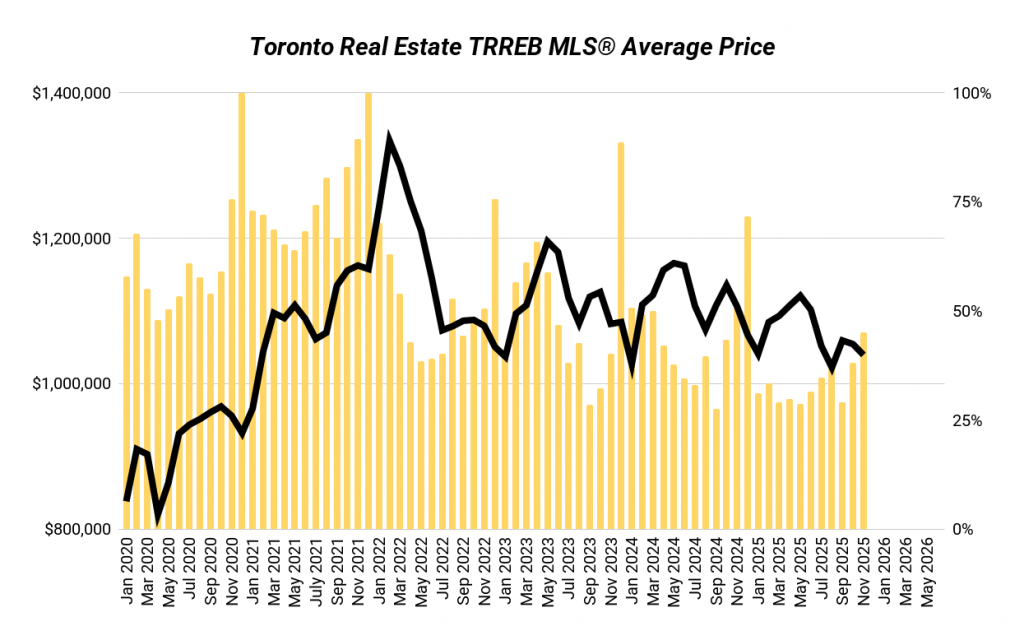

For the full year, GTA REALTORS® reported 62,433 sales through the MLS® System, down 11.2% from 2024—the lowest annual total in 25 years. The average selling price ended at $1,067,968, declining 4.7% year-over-year. In December alone, the average price fell 5.1% to $1,006,735, while the composite benchmark price (a better measure of typical home value) dropped similarly.

TRREB President Daniel Steinfeld described 2025 as a year of increasing affordability, with lower prices and mortgage rates trending down. However, economic uncertainty and high borrowing costs kept many sidelined.

Background shows persistent headwinds: Elevated interest rates early in the year, job market softness, and affordability barriers despite rate cuts. New listings rose 10.1% annually, building inventory and giving buyers leverage—leading to softer negotiations and price adjustments.

Experts remain cautiously optimistic. TRREB Chief Market Analyst Jason Mercer noted that while activity remained subdued, declining rates and population growth could spark recovery in 2026. “The stage is set for improved sales if borrowing costs continue easing,” he said. Some analysts predict moderate price stabilization or modest gains later this year.

Public reactions reflect frustration and opportunity. Sellers lament slower sales and price cuts, while first-time buyers see openings in a less competitive market. Online discussions highlight relief over cooling from peak frenzy, though concerns linger about long-term supply shortages.

For U.S. readers eyeing cross-border trends, Toronto’s slowdown mirrors broader North American patterns—high rates curbing demand despite immigration-driven population booms. It impacts economic ties, with Canadian real estate influencing investment flows and border communities. Lifestyle-wise, more affordable housing could ease pressures on young families and renters considering ownership. Politically, it fuels debates on housing policy, foreign buyers, and interest rate impacts.

Technology plays a role too, with virtual tours and online listings helping navigate low inventory perceptions.

As 2026 begins, all eyes are on Bank of Canada moves and spring momentum.

Toronto housing market 2025 concluded with notable home sales declines, average home prices drop, the lowest sales volume in decades, and a GTA real estate slowdown, paving the way for potential 2026 recovery trends.

By Mark Smith

Follow us on X @realnewshubs and subscribe for push notifications

Follow and subscribe to us to increase push notifications.

Toronto housing market 2025, home sales declines GTA, average home prices drop, lowest sales volume Toronto, GTA real estate slowdown, TRREB December report, Toronto home prices 2025, real estate affordability Canada, 2026 housing recovery, Greater Toronto Area sales