Slight Uptick Alert: US Mortgage Charges Edge Larger as 30-Yr Fastened Common Hits 6.16% – What Homebuyers Have to Know Now

US mortgage charges right this moment, 30-year mounted charge 2026, dwelling mortgage rates of interest, mortgage refinance charges, and housing market affordability are key issues for hundreds of thousands of Individuals navigating the 2026 actual property panorama. As charges inch upward this week, potential patrons and refinancers are carefully anticipating impacts on month-to-month funds and homeownership desires.

A small improve can add up—U.S. mortgage charges have ticked increased, pushing the benchmark 30-year mounted common to six.16% as of January 8, 2026. This modest rise comes amid fluctuating bond yields and financial indicators.

Freddie Mac’s newest Main Mortgage Market Survey, launched right this moment, reveals the 30-year fixed-rate mortgage averaging 6.16%, up barely from final week’s 6.15%. The 15-year mounted charge climbed to five.46%. These weekly figures mirror charges provided to prime debtors.

Different trackers paint an analogous image. Mortgage Information Each day reported each day charges round 6.19% earlier within the week, whereas Bankrate’s survey pegged the 30-year common at 6.16%. Zillow information hovered close to 6%.

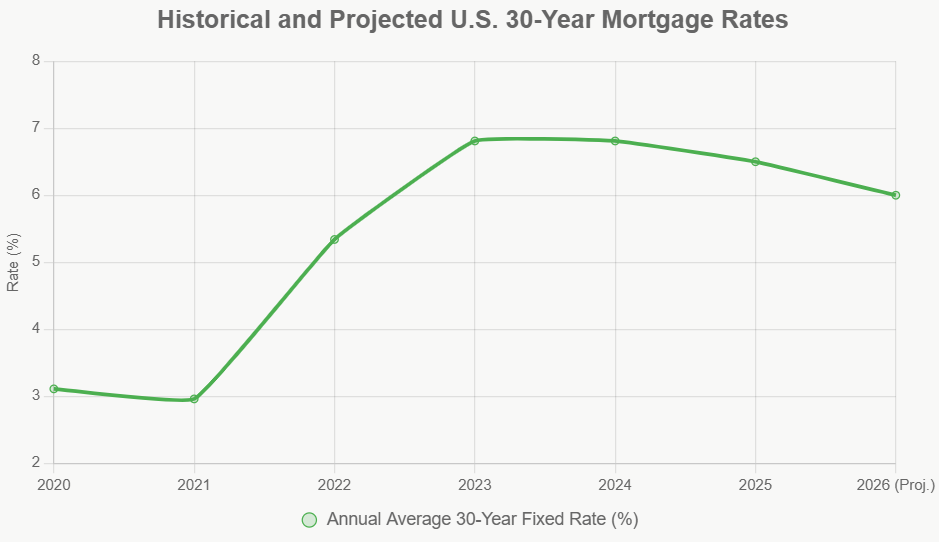

This uptick follows a interval of relative stability in late 2025, when charges dipped beneath 6.5% after Federal Reserve cuts. Robust financial information, together with resilient job progress and protracted inflation hints, have pressured yields on 10-year Treasuries—a key influencer of mortgage pricing.

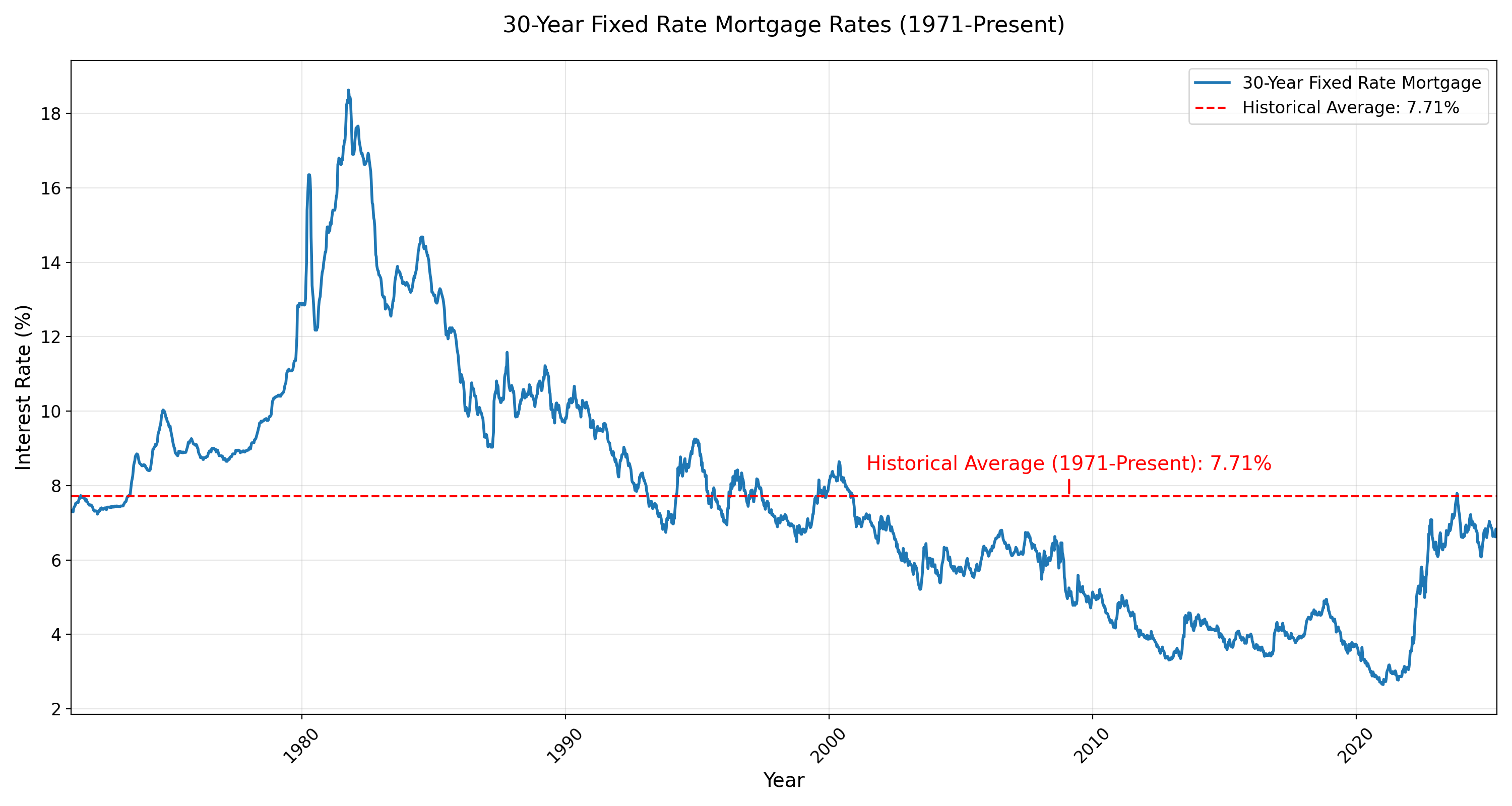

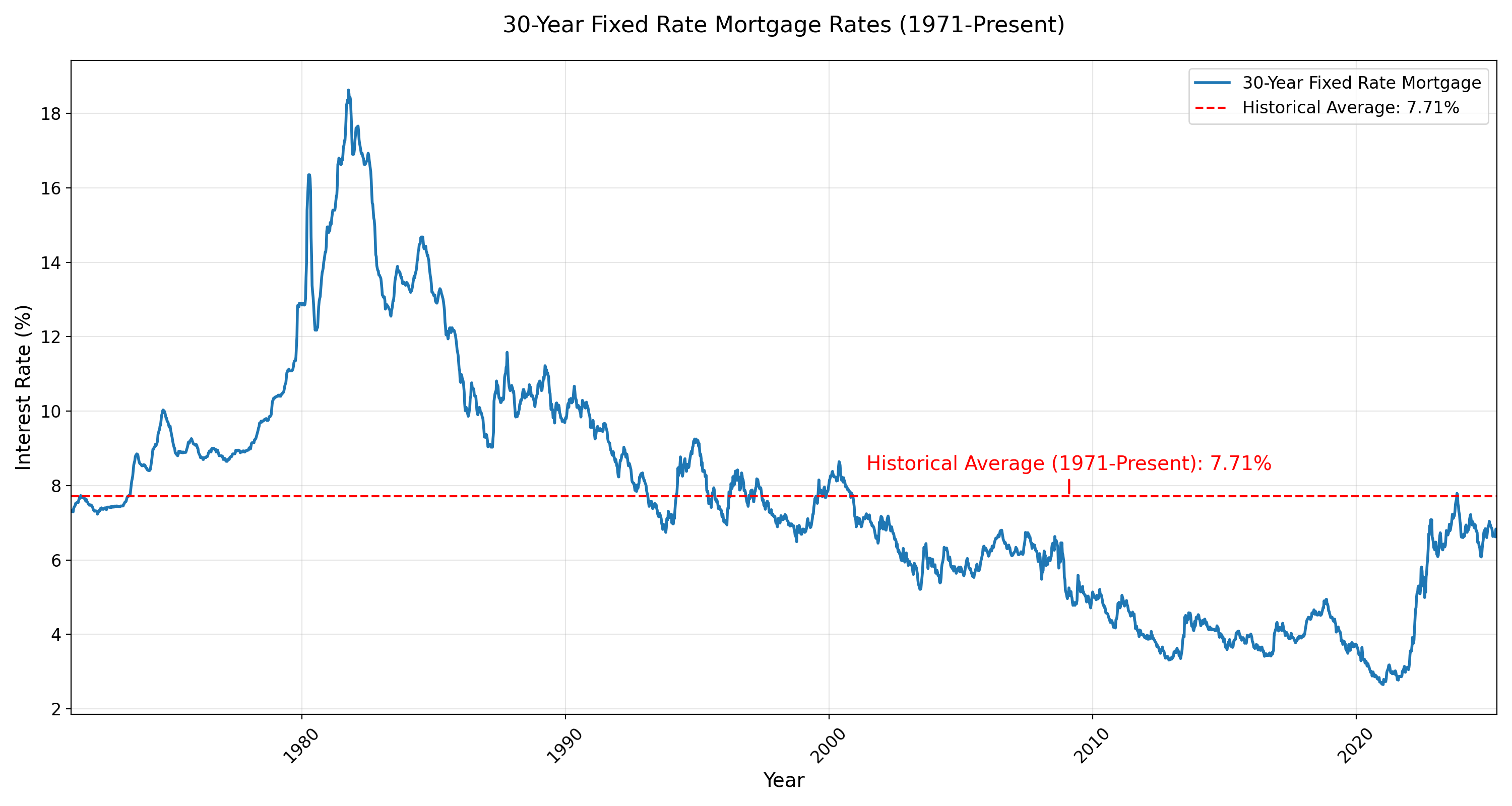

Consultants provide measured views. Sam Khater, Freddie Mac’s chief economist, notes that charges stay in a low-6% vary, far beneath 2023-2024 peaks close to 8%. Nevertheless, forecasts from Fannie Mae and the Mortgage Bankers Affiliation recommend averages might linger round 6.3%-6.4% via a lot of 2026, with potential dips if inflation cools additional.

Public reactions on social media and boards present frustration amongst first-time patrons, who face affordability challenges with dwelling costs nonetheless elevated. Many specific hope for extra Fed cuts, although the central financial institution has signaled warning.

For U.S. shoppers, the implications are clear. A 0.01% weekly rise on a $400,000 mortgage provides simply {dollars} month-to-month, however sustained increased charges might sideline some patrons. Economically, elevated borrowing prices dampen housing exercise, probably slowing worth progress however straining inventory-short markets.

Life-style-wise, increased charges have an effect on large choices—like relocating for jobs or upsizing households. Politically, housing affordability ties into broader debates on financial coverage and Fed independence. Technologically, on-line instruments and charge alerts assist buyers lock in offers shortly.

Refinancers ought to be aware: Present refi charges common increased, round 6.5%-6.7%, making sense primarily for these with charges above 7%.

Patrons can nonetheless discover alternatives. Procuring a number of lenders usually yields higher affords, and credit score enhancements or bigger down funds decrease private charges. Authorities-backed loans like FHA or VA present alternate options with aggressive phrases.

The housing market begins 2026 with cautious optimism. Stock is regularly bettering in some areas, and spring shopping for season might deliver extra choices if charges stabilize.

Consultants advise appearing sooner moderately than ready for dramatic drops. Historic norms place 6% charges as cheap—removed from the sub-3% pandemic lows however sustainable for certified debtors.

As financial stories roll in, together with upcoming jobs information, volatility might persist. Monitoring each day adjustments by way of dependable sources helps time purposes successfully.

For a lot of, homeownership stays attainable with good planning. Price range calculators present that at 6.16%, a $300,000 mortgage carries about $1,830 month-to-month principal and curiosity—manageable for median incomes in lots of areas, excluding taxes and insurance coverage.

Regional variations matter too. Charges and costs differ by state, with hotter markets like California demanding stronger {qualifications}.

US mortgage charges right this moment, 30-year mounted charge 2026, dwelling mortgage rates of interest, mortgage refinance charges, and housing market affordability will proceed shaping choices. Whereas the slight improve tempers enthusiasm, the market affords paths ahead for ready patrons.

The 12 months forward guarantees gradual changes, with potential for aid if progress moderates. Staying knowledgeable positions shoppers to capitalize on alternatives as they come up.

By Mark Smith

Comply with us on X @realnewshubs and subscribe for push notifications

search engine optimisation tags: US mortgage charges 2026, 30-year mounted mortgage charge, right this moment’s mortgage charges, mortgage refinance charges, dwelling mortgage rates of interest, Freddie Mac charges, housing market 2026, mortgage charge forecast, low mortgage charges, dwelling shopping for affordability