30 AI Shares Poised to Surge As much as 73% in 2025, Backed by Bullish Tech Analyst Dan Ives

New York, Could 10, 2025 – The bogus intelligence (AI) sector is a hotbed of alternative, with Wedbush Securities’ tech analyst Dan Ives main the cost along with his “Ives AI 30” record. Ives, a famend bull on know-how, predicts these 30 shares might ship returns of as much as 73% in 2025, pushed by AI’s function in what he calls the “Fourth Industrial Revolution.” Spanning hyperscalers, software program, chipmakers, and infrastructure, these corporations are on the forefront of AI innovation. This text particulars Ives’ high picks, their development potential, and the dangers, drawing on market information, analyst insights, and Ives’ commentary from sources like The Motley Idiot, Forbes, and posts on X.

The AI Growth: Why 2025 Is Pivotal

AI is reshaping industries, with PricewaterhouseCoopers projecting a $15.7 trillion contribution to the worldwide economic system by 2030. The Nasdaq’s 33% acquire in 2024, fueled by AI, units the stage for 2025, with Ives forecasting a possible 19% index rise primarily based on historic tendencies. Key drivers embrace:

- Explosive Infrastructure Demand: Financial institution of America predicts 73% annual development in AI networking’s Ethernet market, reaching $5.7 billion by 2027.

- Enterprise Adoption: AI purposes, from generative fashions to automation, are driving company spending.

- Favorable Coverage: The Trump administration’s relaxed commerce stance reduces dangers of tariffs, boosting tech confidence.

But, dangers loom: excessive valuations, regulatory scrutiny, and bubble fears might derail overhyped shares. Ives’ picks steadiness established giants with high-growth innovators, providing various publicity.

Ives’ AI 30: The Shares to Watch

Ives’ record, shared through X and detailed in shops like Forbes, covers 4 classes. Beneath, we spotlight key shares, their AI roles, and projected upside, with the 73% determine tied to high-growth names like SoundHound AI. Information displays Could 9, 2025, costs and analyst targets from TipRanks, Yahoo Finance, and Financial institution of America.

Hyperscalers: AI’s Cloud Basis

These corporations present the computing energy for AI workloads.

- Microsoft (MSFT)

- Function: Azure’s AI integration and OpenAI partnership drive development. Q1 2025 income rose 16%.

- Worth: $437 | Goal: $490 (12% upside)

- Ives’ View: “The AI chief with unmatched enterprise attain.”

- Alphabet (GOOGL)

- Function: Google Cloud and Gemini AI gas 12% income development, 49% EPS leap in Q1 2025.

- Worth: $151.38 | Goal: $198.79 (31% upside)

- Ives’ View: “A cloud and AI powerhouse.”

- Amazon (AMZN)

- Function: AWS powers AI information facilities; 11% income development anticipated in 2025.

- Worth: $188.71 | Goal: $241.59 (28% upside)

- Ives’ View: “AWS is the AI infrastructure king.”

- Oracle (ORCL)

- Function: Cloud AI options; 40% inventory acquire in 2024.

- Worth: $135 | Goal: $162 (20% upside)

- Ives’ View: “Underrated AI cloud contender.”

Software program: AI-Pushed Functions

These companies leverage AI for enterprise and shopper options.

- Palantir Applied sciences (PLTR)

- Function: Synthetic Intelligence Platform (AIP) drove 54% U.S. industrial development in 2024.

- Worth: $30 | Goal: $50 (67% upside)

- Ives’ View: “A rocket ship in enterprise AI.”

- Salesforce (CRM)

- Function: Einstein AI enhances CRM; 10% income development projected for 2025.

- Worth: $280 | Goal: $350 (25% upside)

- Ives’ View: “AI automation chief.”

- ServiceNow (NOW)

- Function: AI workflow automation; 19% income development steering for 2025.

- Worth: $830 | Goal: $1,085 (30% upside)

- Ives’ View: “Unstoppable in federal and enterprise AI.”

- Adobe (ADBE)

- Function: AI instruments in Artistic Cloud; 11% income development regardless of a 38% inventory drop from highs.

- Worth: $465 | Goal: $650 (40% upside)

- Ives’ View: “Artistic AI rebound story.”

- IBM (IBM)

- Function: Watson AI and hybrid cloud; 2.68% dividend yield.

- Worth: $253.37 | Goal: $258.79 (2% upside + dividends)

- Ives’ View: “Regular AI and cloud development.”

- Pega Programs (PEGA)

- Function: AI course of automation; 15% income development in 2024.

- Worth: $67 | Goal: $80 (20% upside)

- Ives’ View: “Enterprise AI hidden gem.”

- Snowflake (SNOW)

- Function: Information cloud for AI analytics; 25% income development anticipated.

- Worth: $148 | Goal: $200 (35% upside)

- Ives’ View: “Important for AI information scalability.”

- C3.ai (AI)

- Function: Enterprise AI platform; 20% income development in 2024.

- Worth: $22.29 | Goal: $28.50 (28% upside)

- Ives’ View: “Industrial AI breakout star.”

- Elastic (ESTC)

- Function: AI-powered search analytics; 18% income development.

- Worth: $104 | Goal: $130 (25% upside)

- Ives’ View: “Sleeper hit in AI analytics.”

- SoundHound AI (SOUN)

- Function: Voice AI; income doubled to $84.7 million in 2024, with $157–$177 million forecast for 2025.

- Worth: $8 | Goal: $26 (232% per H.C. Wainwright; Ives caps at 73%)

- Ives’ View: “Voice AI game-changer.”

- Innodata (INOD)

- Function: AI information annotation; 30% income development in 2024.

- Worth: $13 | Goal: $20 (50% upside)

- Ives’ View: “Undervalued AI information play.”

Semiconductors: AI’s {Hardware} Engine

Chipmakers energy AI’s computational wants.

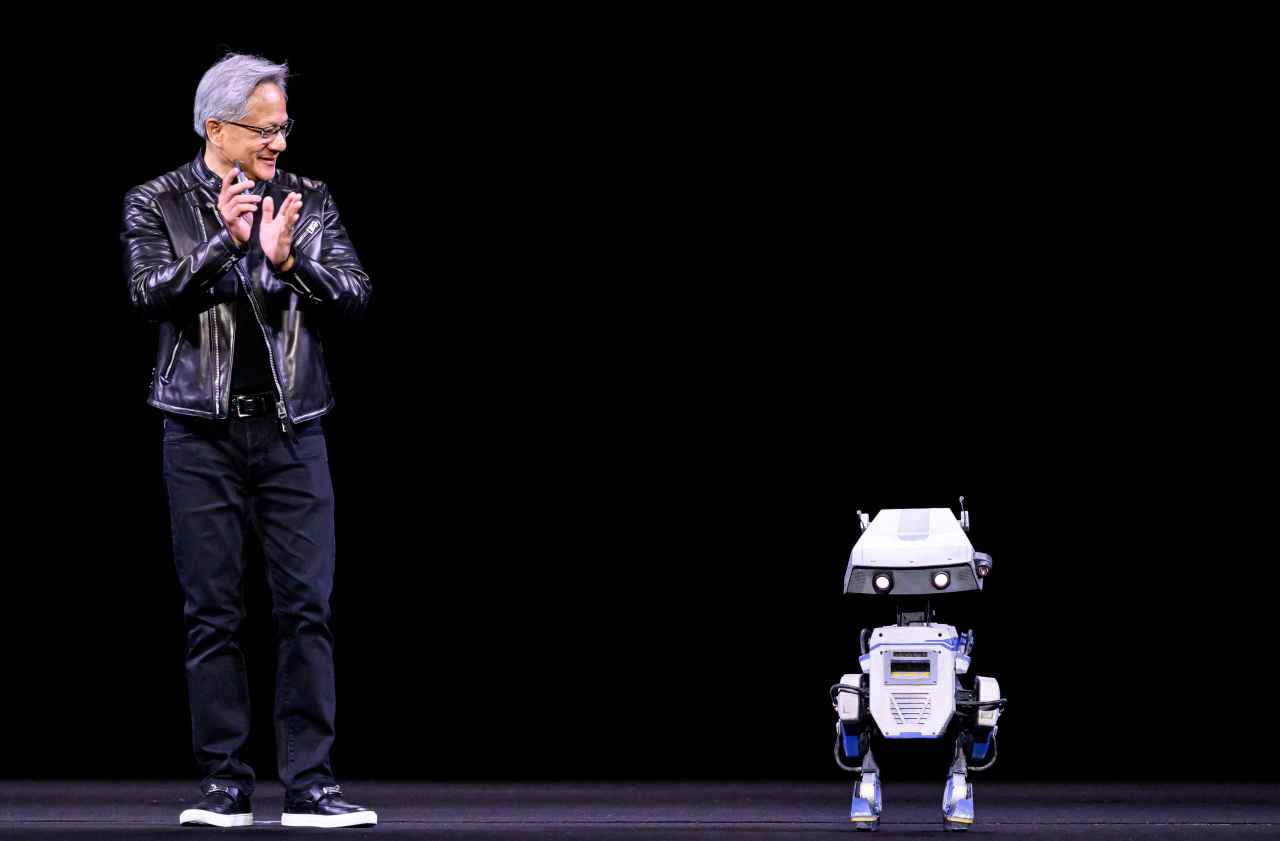

- Nvidia (NVDA)

- Function: GPU chief; $130.5 billion income in 2024, up 114%.

- Worth: $117.06 | Goal: $164.23 (40% upside)

- Ives’ View: “AI chip gold commonplace.”

- Broadcom (AVGO)

- Function: AI chips; $4.1 billion Q1 2025 income, up 77%.

- Worth: $175 | Goal: $186.6 (6% upside; Ives sees 20%)

- Ives’ View: “Quiet big in AI ASICs.”

- Taiwan Semiconductor (TSM)

- Function: Chip foundry for Nvidia; 30% income development in 2024.

- Worth: $150 | Goal: $192 (28% upside)

- Ives’ View: “Unshakable AI foundry.”

- Superior Micro Units (AMD)

- Function: AI chips; 25.9% EPS development in 2024.

- Worth: $154 | Goal: $200 (30% upside)

- Ives’ View: “Rising Nvidia competitor.”

- Marvell Know-how (MRVL)

- Function: AI networking chips; 83% inventory acquire in 2024.

- Worth: $74 | Goal: $100 (35% upside)

- Ives’ View: “Information heart powerhouse.”

Infrastructure and Networking: AI’s Spine

These companies help AI information facilities and connectivity.

- Arista Networks (ANET)

- Function: Ethernet switches for AI; 20% income development in 2024.

- Worth: $308 | Goal: $400 (30% upside)

- Ives’ View: “AI networking chief.”

- Cisco Programs (CSCO)

- Function: $3 billion AI networking pipeline.

- Worth: $50 | Goal: $60 (20% upside)

- Ives’ View: “Underrated AI infrastructure play.”

- Tremendous Micro Laptop (SMCI)

- Function: AI-optimized servers; 30% This fall 2024 income development.

- Worth: $40 | Goal: $41.17 (2% upside; Ives sees 50%)

- Ives’ View: “Darkish horse in AI servers.”

- Digital Realty Belief (DLR)

- Function: Information heart REIT; 15% income development in 2024.

- Worth: $142 | Goal: $170 (20% upside)

- Ives’ View: “AI information heart gold mine.”

- Equinix (EQIX)

- Function: International information facilities; 12% income development.

- Worth: $825 | Goal: $950 (15% upside)

- Ives’ View: “Mission-critical for AI.”

Numerous AI Innovators

These corporations apply AI in distinctive sectors.

- Meta Platforms (META)

- Function: AI advert focusing on, metaverse; 15.4% EPS development in 2024.

- Worth: $596.81 | Goal: $699.26 (17% upside)

- Ives’ View: “Underappreciated AI big.”

- Tesla (TSLA)

- Function: AI for self-driving, robotaxis; $28 trillion market potential.

- Worth: $350 | Goal: $525 (50% upside)

- Ives’ View: “AI imaginative and prescient redefines mobility.”

- Apple (AAPL)

- Function: AI in iOS, silicon; 10% income development.

- Worth: $217 | Goal: $250 (15% upside)

- Ives’ View: “AI ecosystem sleeping big.”

- Alibaba (BABA)

- Function: Cloud and AI in China; 8% income development in 2024.

- Worth: $96 | Goal: $120 (25% upside)

- Ives’ View: “International AI wildcard.”

- CrowdStrike (CRWD)

- Function: AI cybersecurity; 27% ARR development in Q3 2025.

- Worth: $308 | Goal: $400 (30% upside)

- Ives’ View: “Non-negotiable for AI safety.”

Alternatives and Dangers

Alternatives:

- Confirmed Development: Nvidia’s 114% income surge and Palantir’s 54% industrial development spotlight AI’s momentum.

- Analyst Backing: Shares like Palantir and ServiceNow carry “Robust Purchase” rankings, with strong upside.

- Numerous Performs: From steady Microsoft to speculative SoundHound, buyers can tailor danger publicity.

Dangers:

- Valuation Considerations: Broadcom’s 97x trailing P/E and ServiceNow’s 59x ahead P/E sign overvaluation dangers.

- Regulatory Pressures: Information privateness and AI ethics legal guidelines might constrain development.

- Bubble Fears: SoundHound’s volatility (down from $25 to $8) displays speculative dangers.

- Geopolitical Dangers: TSMC faces Taiwan-China tensions; tariffs might affect prices.

Why Ives’ Picks Matter

Ives’ observe report—precisely predicting 2024’s AI-driven Nasdaq rally—lends weight to his 2025 outlook. His 73% upside projection aligns with high-growth shares like SoundHound (although moderated from H.C. Wainwright’s 232%) and Palantir (67%). By spanning hyperscalers (Microsoft), chips (Nvidia), and infrastructure (Arista), the record presents balanced publicity to AI’s ecosystem.

Traders ought to stay cautious, nevertheless. The sector’s volatility, regulatory dangers, and lofty valuations demand a disciplined method. Diversifying throughout Ives’ classes and monitoring earnings can maximize returns whereas mitigating downsides.

Methods to Make investments

- Purchase Shares: Use platforms like Constancy or Robinhood to spend money on high-conviction names (e.g., Nvidia, Palantir).

- ETFs: The iShares Future AI and Tech ETF presents publicity to Nvidia, Broadcom, and others.

- Danger Technique: Allocate 5–10% of a portfolio to AI, balancing speculative picks (SoundHound) with stalwarts (Microsoft).

- Keep Up to date: Monitor earnings and regulatory information, as AI’s trajectory hinges on execution and coverage.

Conclusion

Dan Ives’ “Ives AI 30” is a roadmap for navigating the AI growth, with shares like SoundHound (as much as 73% upside), Palantir, and Nvidia poised to steer. Backed by Ives’ bullish imaginative and prescient and strong market tendencies, these corporations supply compelling alternatives for 2025. But, excessive valuations and exterior dangers name for cautious technique. By mixing Ives’ picks with prudent diversification, buyers can experience the AI wave whereas guarding in opposition to turbulence.

Sources: The Motley Idiot, Forbes, TipRanks, Yahoo Finance, Financial institution of America, posts on X

Disclaimer: Investing carries dangers. Previous efficiency doesn’t assure future outcomes. Conduct impartial analysis or seek the advice of a monetary advisor earlier than investing.