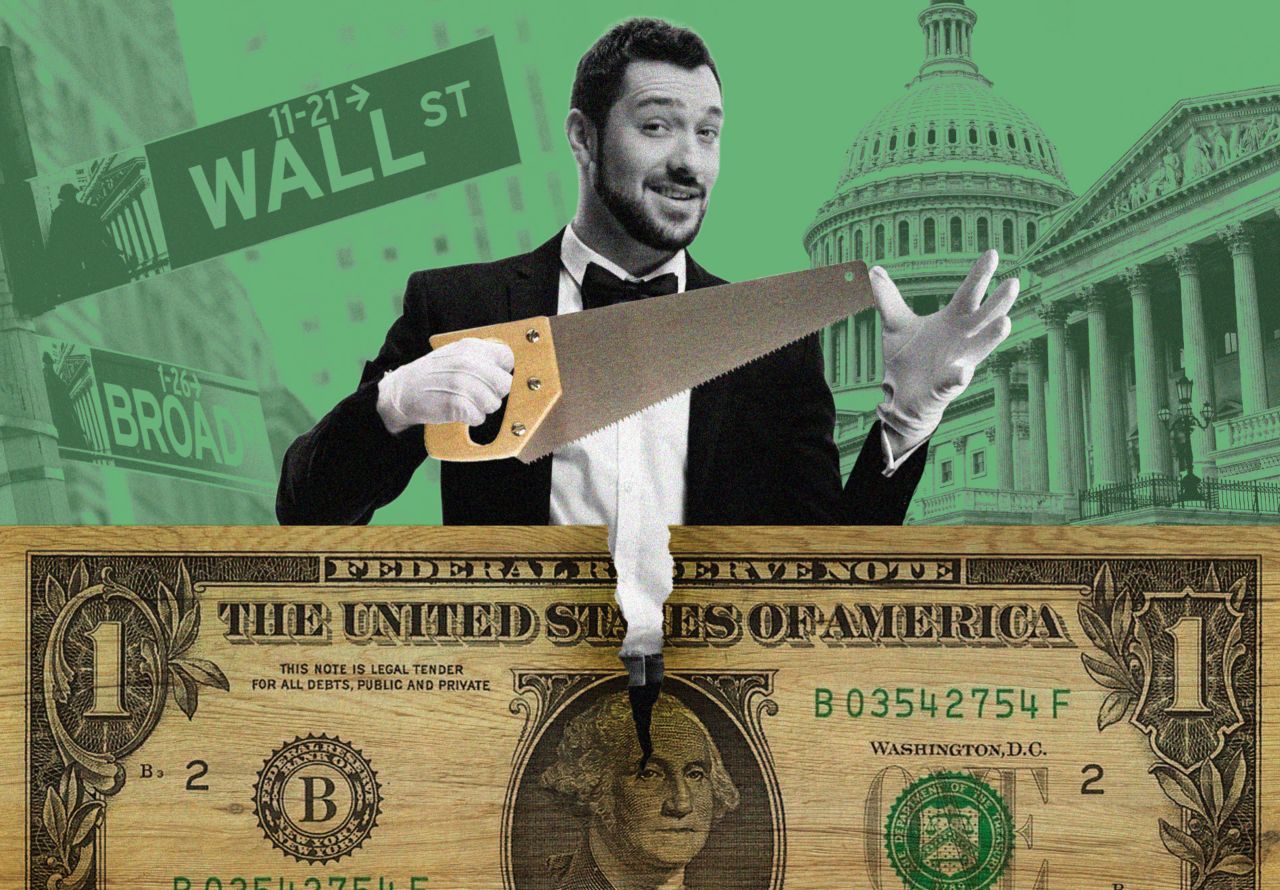

Washington’s Next Trick: Sawing the Dollar’s Value in Half?

Picture this: A magician steps onto the stage, waving a top hat labeled “U.S. Economy,” pulls out a saw, and begins slicing through a giant greenback. The audience gasps as the dollar halves before their eyes—poof! It’s gone, replaced by rising prices and jittery markets. This isn’t a Vegas act; it’s the grim reality facing the U.S. dollar in 2025, where Washington’s policies are fueling fears of deliberate devaluation. With the greenback already down over 10% in the first half of the year—its worst slump since 1973—investors are whispering: Is this erosion accidental, or the next big illusion?

The Dollar’s Dramatic Decline: A 2025 Wake-Up Call

The U.S. dollar index (DXY), which tracks the greenback against a basket of major currencies, plunged 10.7% in the first six months of 2025, marking its steepest drop since the turbulent 1970s. By July, a brief rebound of 3.2% offered fleeting relief, but analysts warn the downward spiral persists, driven by sluggish U.S. growth forecasts—now hovering at 1.4% for the year—and ballooning deficits.

At the heart of this malaise is the “One Big Beautiful Bill Act” (OBBBA), a sweeping $4.1 trillion spending and tax package signed by President Trump on July 4, 2025. Critics argue it exacerbates the national debt, now exceeding $35 trillion, prompting Moody’s to downgrade U.S. credit in May and spurring an exodus from Treasuries. Gold, the ultimate hedge, has soared past $3,700 per ounce, signaling investor panic over fiat currency erosion. As one X user quipped amid the frenzy, “We’re experiencing real-time speeding up of the dollar devaluation… hyperinflation is just around the corner.”

Policy Chaos as the Saw: Tariffs, Rates, and Fiscal Fireworks

Washington’s “trick” isn’t sleight of hand—it’s a cocktail of tariffs, rate-cut pressures, and fiscal recklessness. Trump’s aggressive trade barriers, including sweeping duties on imports from China and Europe, aim to revive manufacturing but have backfired on the dollar. By curbing imports, fewer dollars flow abroad, reducing global demand for the currency. Foreign investors, spooked by the unpredictability, have dumped $63 billion in U.S. equities since March.

Enter the Federal Reserve: Trump has urged rate cuts—potentially two to three by year-end—to juice the economy, but this risks further weakening the dollar against higher-yielding peers like the euro. Economist Kenneth Rogoff, former IMF chief, pins the blame on years of debt inaction: “We’re coming from a very strong dollar level… but Trump’s policies have shaken confidence.” Project 2025, the conservative blueprint, even floats exiting the IMF—a move that could mechanically unwind global dollar reserves, amplifying the slide.

Yet, whispers of a “Mar-a-Lago Accord”—a modern Plaza Accord to engineer dollar weakness—circulate in policy circles, potentially halving its value to erase trade deficits. As Reuters notes, history shows such devaluations are rare and chaotic, but necessary for rebalancing. On X, sentiment echoes: “A severe depression is now inevitable” as devaluation spirals.

The Half-Sawed Dollar: Impacts on Everyday Americans and the World

Halving the dollar’s value sounds hyperbolic, but a 50% drop—like the 1985-87 Plaza era—could ignite inflation, erode savings, and spike import costs from groceries to gas. For U.S. consumers, it’s a stealth tax: Everyday items become pricier, while exporters cheer cheaper goods abroad. Globally, de-dollarization accelerates—central banks hoard gold, BRICS nations pivot to alternatives, threatening America’s “exorbitant privilege.”

Experts diverge: J.P. Morgan sees the dollar’s reserve status enduring at 58% of global holdings, but Chatham House warns of “needless self-harm” if policies weaponize it. Investor Richard Duncan advises: “The dollar is likely to depreciate considerably further—position accordingly.”

The Grand Illusion: Will the Dollar Vanish?

Washington’s fiscal sawing act has already halved the dollar’s strength this year, but the full trick—intentional devaluation to $0.50 on the index—looms if tariffs and deficits unchecked. While boosters like Trump tout manufacturing revival, the real winners may be gold bugs and foreign rivals. As one analyst puts it, “The dollar’s slide signals America losing its financial might.” For investors and citizens, the curtain’s rising: Hedge now, or risk being sawed in half. What’s your next move in this high-stakes show?

Washington dollar devaluation 2025, US currency decline, Trump tariffs impact dollar, dollar weakening policies, gold surge dollar fall, fiscal deficit dollar value, Mar-a-Lago Accord, Project 2025 IMF exit, US economy 2025 outlook