Coinbase One Card Review: Up to 4% Bitcoin Back, but Is It Worth the Wait?

A New Crypto Credit Card Sparks Buzz

Coinbase, a leading U.S. cryptocurrency exchange, is set to launch the Coinbase One Card in fall 2025, promising up to 4% back in Bitcoin on every purchase. With a waitlist open and excitement building, this American Express credit card aims to rival other crypto rewards cards, but its tiered structure and membership requirements raise questions about its value for everyday consumers.

Key Features of the Coinbase One Card

Rewards Structure

- Bitcoin Rewards: Earn 2% to 4% back in Bitcoin on all eligible purchases, with rates tiered based on the value of assets held on Coinbase (including USD, USDC, or other cryptocurrencies). The base rate is 2%, with higher tiers (2.5%, 3%, or 4%) unlocked by holding more assets, though exact thresholds remain undisclosed until launch.

- No Annual Fee for the Card: The card itself has no annual fee, but a Coinbase One membership is required, costing $4.99/month or $49.99/year for the Basic tier.

- No Foreign Transaction Fees: Ideal for international purchases, enhancing its appeal for frequent travelers.

- Repayment Flexibility: Pay your balance via linked bank account or crypto held on Coinbase, offering versatility for crypto enthusiasts.

Additional Benefits

- AmEx Perks: As an American Express card, it includes protections like retail protection, extended warranty, lost luggage insurance, and trip cancellation/interruption coverage, plus access to AmEx Experiences™ and Offers.

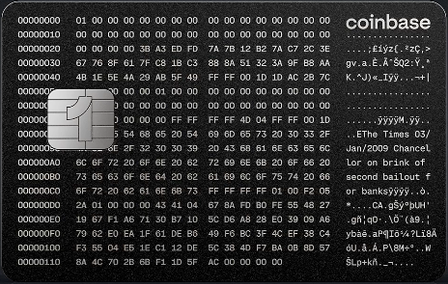

- Stainless Steel Design: A 17-gram card etched with Bitcoin’s Genesis Block text, appealing to crypto fans seeking a premium feel.

- Coinbase One Membership Perks: Beyond the card, the $49.99/year Basic membership offers zero trading fees on up to $500 in monthly trades, 4.5% APY on the first $10,000 of USDC, and $10/month in Base gas credits for DeFi transactions.

Eligibility and Availability

- U.S.-Only Launch: Available initially to Coinbase One members in the U.S. (excluding territories), with a waitlist open now and a rollout planned for fall 2025.

- Membership Requirement: An active Coinbase One subscription is mandatory, and cancellation may lead to card account closure.

- Credit Approval: Subject to creditworthiness, issued by First Electronic Bank and powered by Cardless.

Pros and Cons

Pros

- High Rewards Potential: Up to 4% Bitcoin back is competitive, especially compared to Gemini’s 4% on gas/transit (capped) or Crypto.com’s 5% in CRO (tied to ecosystem tiers).

- No Annual Card Fee: Unlike some rewards cards, the card itself is free, though the Coinbase One membership adds a cost.

- AmEx Benefits: Robust protections and perks enhance value for frequent shoppers and travelers.

- Flexible Payments: Paying with crypto or fiat offers unique flexibility for Coinbase users.

Cons

- Unclear Reward Tiers: Coinbase hasn’t disclosed asset thresholds for higher rates (e.g., 3% or 4%), making it hard to assess value. Estimates suggest $200,000 in assets for 4%, a high bar for most.

- Membership Cost: The $49.99/year Coinbase One fee reduces net rewards, especially for low spenders. For example, at 2% back, you’d need $2,500 in annual spending to break even.

- Bitcoin Volatility: Rewards in Bitcoin are subject to price swings, unlike stable cash-back cards, adding risk.

- Tax Complexity: Bitcoin rewards are taxable as capital gains, requiring tracking of each reward’s cost basis, though Coinbase’s reporting tools may simplify this.

- Waitlist Uncertainty: Some users report long wait times for crypto cards, and Coinbase’s history with waitlists (e.g., Robinhood Gold) raises concerns about accessibility.

Comparison to Competitors

- Gemini Credit Card: No annual fee or membership, offering 4% back on gas/transit (capped at $300/month), 3% on dining, 2% on groceries, and 1% elsewhere, with rewards in Bitcoin or 50+ cryptocurrencies. It’s more flexible but less rewarding for non-category spending.

- Crypto.com Visa Signature: Up to 5% back in CRO (6.5% in first year for some tiers), no subscription, but rewards are tied to Crypto.com’s ecosystem and CRO’s volatility.

- Traditional Cash-Back Cards: Cards like the Citi Double Cash (2% back) or Chase Freedom Unlimited (1.5–5%) offer predictable rewards without crypto volatility or membership fees, appealing to risk-averse consumers.

Impact on U.S. Consumers

Financial Benefits

- Crypto Portfolio Growth: For Coinbase users, earning Bitcoin on everyday spending (e.g., $1,200 annually at 4% on $30,000 spending) can boost crypto holdings, especially if Bitcoin’s price rises (currently ~$58,000 in September 2025).

- Cost Savings: No foreign transaction fees and AmEx protections add value for frequent travelers and shoppers.

- Membership Value: The Coinbase One Basic tier’s benefits (4.5% USDC APY, zero trading fees) could offset the $49.99 cost for active traders or DeFi users, making the card more appealing.

Risks and Considerations

- High Asset Thresholds: Achieving 4% back may require substantial Coinbase holdings, potentially risky given the “not your keys, not your crypto” mantra.

- Economic Context: With U.S. mortgage rates at 6.85% and home prices at $412,300 (Q2 2025), consumers may prioritize stable cash-back over volatile crypto rewards.

- Accessibility: The waitlist and membership requirement may limit access, especially for non-Coinbase users or those with lower credit scores.

Lifestyle Impact

The card caters to crypto enthusiasts and tech-savvy spenders, particularly younger demographics engaged in DeFi or NFTs on Coinbase’s Base platform. However, its niche appeal may not suit budget-conscious consumers avoiding crypto volatility or those uninterested in maintaining a Coinbase One membership.

Public and Expert Reactions

On X, sentiment is mixed. @CryptoFanatic hails the card as “a game-changer for stacking sats,” while @FinanceSkeptic warns, “Sounds great until you realize the tax hassle and membership cost.” Analysts like CNET’s Courtney Johnston recommend waiting for clarity on reward tiers, citing the $49.99 membership as a potential dealbreaker for low spenders.

Future Outlook

The Coinbase One Card’s success hinges on its rollout and transparency. If asset thresholds for 4% back are reasonable (e.g., $10,000–$50,000), it could compete with Gemini and Crypto.com. However, high thresholds ($200,000) or delays in clearing the waitlist could dampen enthusiasm, as seen in Reddit discussions about similar cards. A potential Fed rate cut in September 2025 could boost consumer spending, enhancing the card’s appeal, but tariff-driven inflation may keep budgets tight.

Conclusion

The Coinbase One Card offers a compelling 2–4% Bitcoin rewards rate and AmEx perks, making it attractive for crypto enthusiasts with significant Coinbase holdings. However, the $49.99/year membership, unclear reward tiers, and Bitcoin’s volatility pose challenges. Consumers should weigh the card’s benefits against traditional cash-back options and join the waitlist to assess full terms at launch. For now, it’s a promising but niche offering in the evolving crypto rewards space.