As the insurance industry enters 2026, elevated cat losses, AI in commercial insurance, catastrophe losses 2026, commercial insurance trends, and Swiss Re outlook are dominating discussions among carriers, brokers, and corporate clients. Swiss Re Corporate Solutions CEO Ivan Gonzalez has warned that these elements represent not fleeting challenges but deep structural changes reshaping risk management, underwriting, and partnerships.

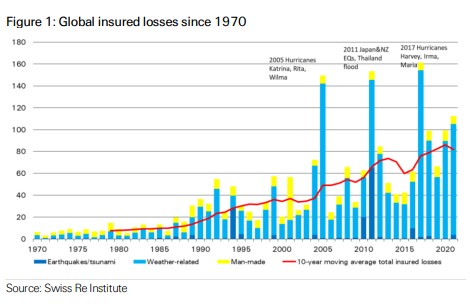

The backdrop is a world of heightened volatility, where climate-driven events have pushed annual insured catastrophe losses consistently above historical norms. Recent years have seen totals clustering near or exceeding $150 billion—far from the $100 billion mark once considered a “bad” year. Gonzalez highlighted that this elevated baseline persists, fueled by natural perils like hurricanes, wildfires, severe convective storms, and floods, alongside man-made losses and ongoing economic uncertainty.

Here are striking visuals of recent global catastrophe impacts, underscoring the scale of losses driving 2026 concerns:

For large corporates, this reality is prompting a shift toward innovative risk financing. Captives, parametric insurance solutions, and insurance-linked securities like catastrophe bonds are gaining traction, offering more flexible and tailored protection against unpredictable exposures.

At the same time, accelerating adoption of artificial intelligence is transforming the commercial lines landscape. AI tools are enhancing underwriting precision, claims processing, risk assessment, and predictive modeling—enabling carriers to handle complex data faster and more accurately.

These images illustrate how AI is revolutionizing insurance operations, from predictive analytics to automated decision-making:

Experts like Gonzalez describe the 2026 environment as one where property insurance continues as a key growth driver, with rising asset values and expanding exposures sustaining demand. Swiss Re’s refreshed strategy aims for $4.5 billion in income by year-end, built on a “built to lead” approach that emphasizes innovation amid volatility.

Industry reports from Willis, Deloitte, and others echo this outlook: abundant capital supports stability in many lines, yet persistent cat losses and geopolitical factors could reverse gains quickly. The U.S. casualty market shows signs of discipline after post-pandemic disruptions, with focus on data-centric underwriting and strong risk controls.

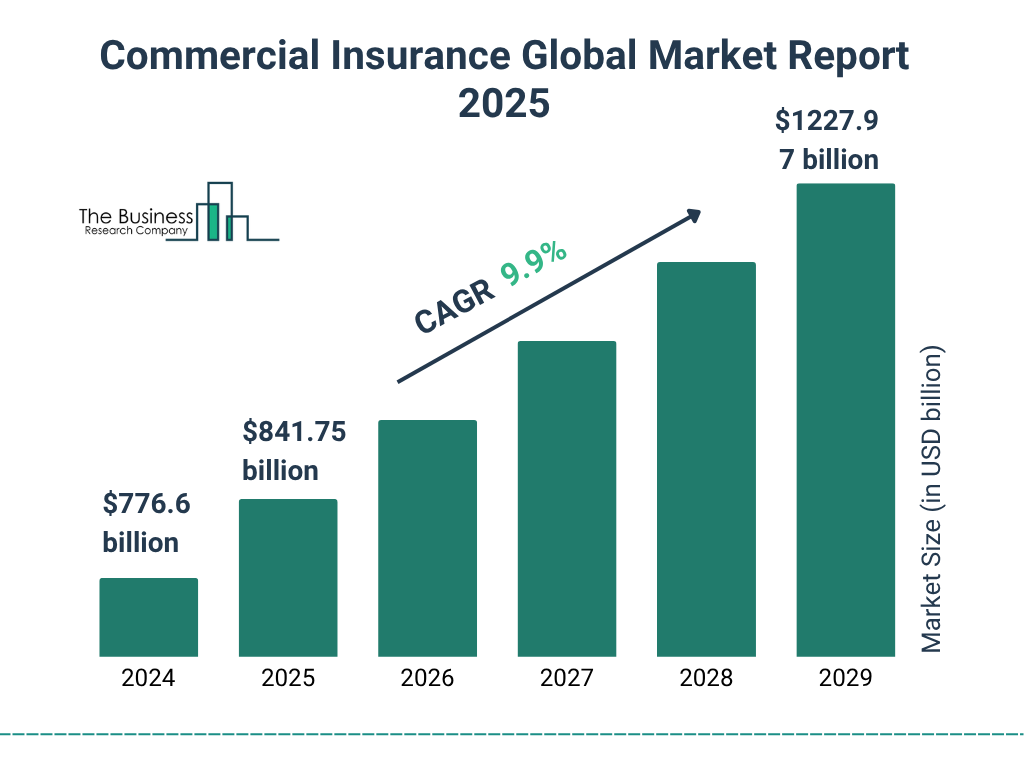

Broader market charts highlight the evolving commercial insurance sector:

For U.S. businesses and readers, these trends carry significant implications. Elevated cat losses could drive higher premiums in high-risk areas, while AI adoption promises more efficient, personalized coverage and faster claims—potentially lowering costs for well-managed risks. Economically, it supports resilience in sectors vulnerable to climate events, from real estate to manufacturing. Politically, debates on insurance affordability and mitigation incentives intensify as losses mount.

Public and expert reactions emphasize proactive strategies: carriers are urged to invest in AI governance, parametric pilots, and community resilience to navigate the year ahead.

In summary, elevated cat losses and accelerating AI adoption are setting a defining tone for commercial insurance in 2026, marking structural evolution toward smarter, more resilient risk management. As volatility endures, carriers embracing these forces stand to lead in a transformed market, delivering value through innovation in elevated cat losses, AI in commercial insurance, catastrophe losses 2026, commercial insurance trends, and Swiss Re outlook.