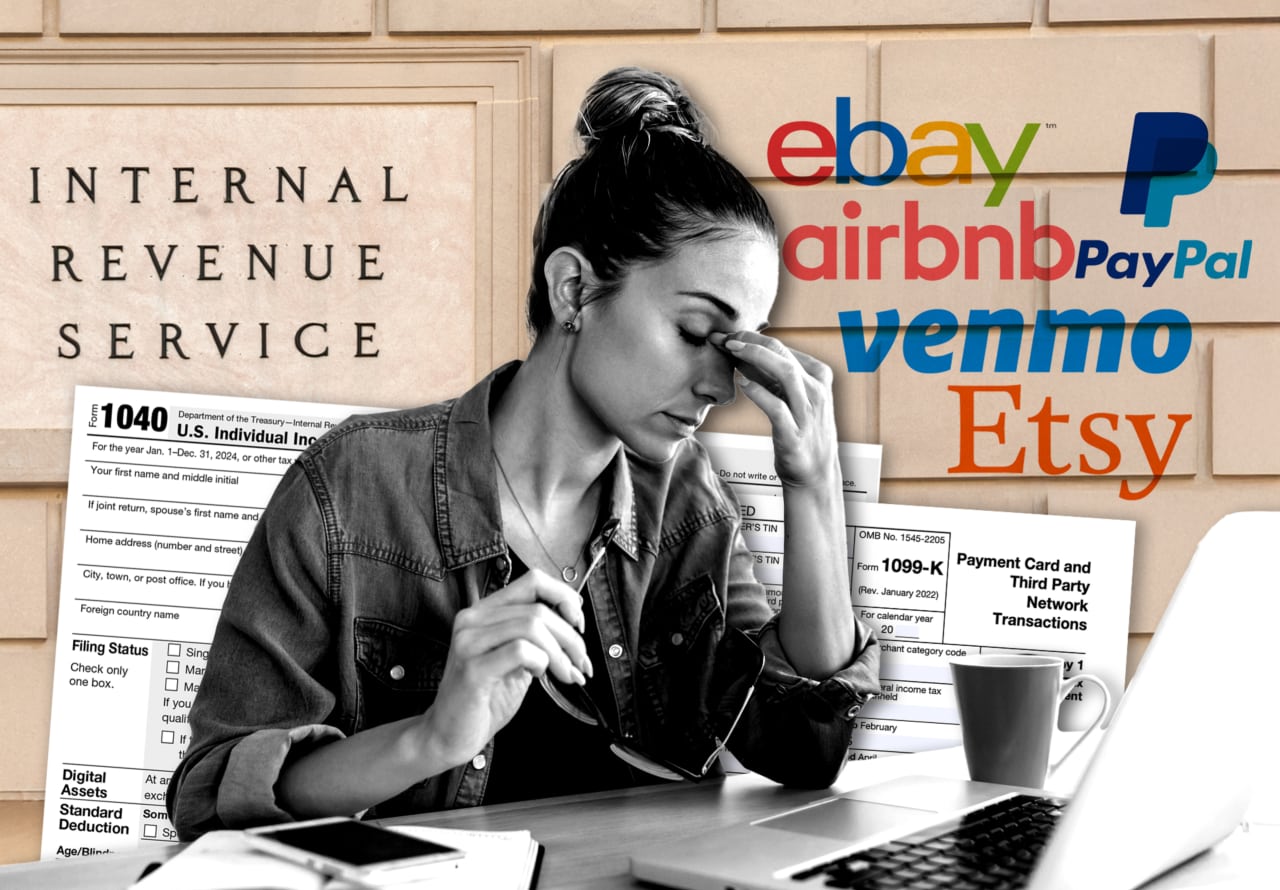

GOP Megabill Targets Repeal of $600 IRS Reporting Threshold for Venmo, PayPal Payments

June 16, 2025 – A Republican-led “megabill,” dubbed the “One Big Beautiful Bill,” is gaining traction in Congress and appears set to repeal the controversial $600 tax-reporting threshold for third-party payment apps like Venmo, PayPal, and Cash App. Introduced as part of the American Rescue Plan Act of 2021, the rule requires platforms to issue Form 1099-K to users with transactions exceeding $600 annually for goods or services, a sharp drop from the prior $20,000 and 200-transaction threshold.

The Saving Gig Economy Taxpayers Act (H.R. 190), spearheaded by Rep. Carol Miller (R-W.Va.), passed the House Ways and Means Committee on September 11, 2024, by a 22-16 vote, with full Republican support. It aims to restore the original $20,000/200-transaction threshold, easing burdens on gig workers and casual sellers. Posts on X highlight strong GOP backing, with @WaysandMeansGOP stating, “Democrats’ $600 rule imposed regulatory burdens on Americans selling items like furniture or tickets.”

The IRS delayed the $600 rule’s implementation multiple times, citing confusion among taxpayers and processors, and set a $5,000 threshold for 2024, with plans to lower it to $2,500 in 2025 and $600 in 2026. Critics, including small business owners, argue the low threshold overwhelms users with paperwork for non-taxable transactions, like selling used items at a loss. Supporters, however, claim it closes a $166 billion tax gap by catching unreported income.

With President Trump’s support, the bill’s passage could protect millions from unexpected 1099-K forms. However, Democrats oppose the repeal, arguing it undermines tax compliance. A final vote looms as the IRS prepares to enforce the $5,000 threshold for 2024 filings.