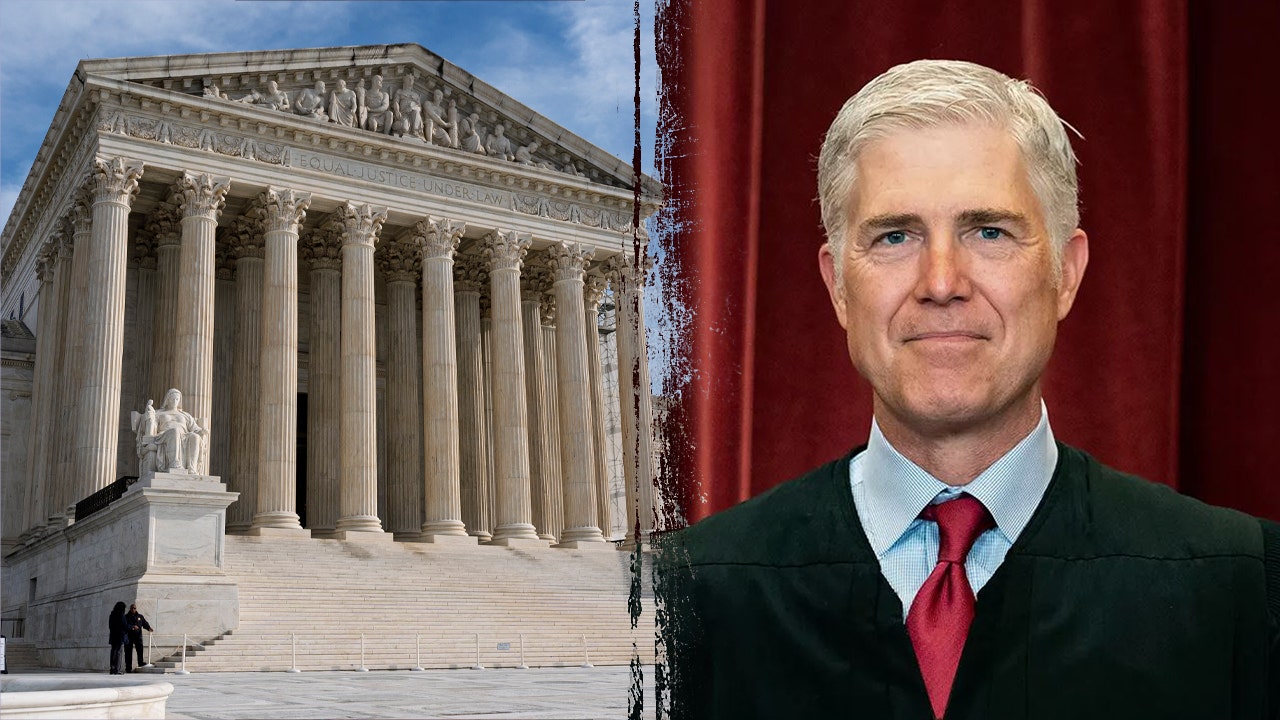

In a sharply divided 8-1 Supreme Court ruling on June 12, 2025, the Internal Revenue Service (IRS) was handed what Justice Neil Gorsuch called a “powerful new tool to avoid accountability” in the case of Commissioner of Internal Revenue v. Zuch. The majority opinion, supported by eight justices, held that U.S. Tax Court proceedings become moot if the IRS drops its request for a tax levy, effectively shielding the agency from judicial review of its actions. Gorsuch, the lone dissenter, argued that this decision undermines taxpayers’ ability to challenge IRS errors and recover overpayments, raising serious concerns about unchecked government power.

The Case: Commissioner of Internal Revenue v. Zuch

The case centered on Ms. Zuch, who sought to challenge an IRS levy in Tax Court, alleging the agency had wrongly retained overpayments. Under Section 6330 of the Internal Revenue Code, taxpayers can contest IRS levies before they are enforced, ensuring due process. However, the IRS withdrew its levy during the proceedings, prompting the majority to declare the case moot, as there was no longer an active levy to dispute. This ruling prevents Ms. Zuch—and potentially other taxpayers—from pursuing claims that the IRS miscalculated or unlawfully withheld funds.

Gorsuch’s dissent lambasted the decision, arguing it creates a loophole for the IRS to evade scrutiny. He wrote, “Today’s decision holding otherwise leaves Ms. Zuch with no meaningful way to pursue her argument that the IRS erred or to recoup the overpayments she believes the IRS has wrongly retained.” By allowing the IRS to moot cases by withdrawing levies, the Court effectively grants the agency the ability to sidestep judicial oversight, even when its actions may be erroneous or arbitrary.

Gorsuch’s Broader Critique

Gorsuch’s dissent reflects his broader concerns about the erosion of judicial power and the expansion of administrative authority. He warned that the ruling makes Section 6330 proceedings “essentially risk-free for the IRS,” allowing the agency to pursue levies, argue its case in Tax Court, and then withdraw the levy if the court seems likely to rule against it. This, he argued, undermines the separation of powers and the judiciary’s role in holding government agencies accountable.

His critique echoes themes from his earlier dissents, such as in Thryv Inc. v. Click-to-Call Technologies (2020), where he decried the ceding of judicial power to bureaucracies, and Toth v. United States (2023), where he challenged a $2.17 million IRS penalty as an excessive fine under the Eighth Amendment. In Toth, Gorsuch argued that the IRS’s civil penalties, like those for failing to file a Report of Foreign Bank and Financial Accounts (FBAR), can serve as punishment, not merely remediation, and should be subject to constitutional scrutiny. The Zuch ruling, in his view, further insulates the IRS from such checks.

Implications for Taxpayers

The Zuch decision has significant implications for taxpayers. By declaring cases moot when the IRS withdraws a levy, the Court limits taxpayers’ ability to challenge IRS actions in court, even when they believe the agency has overstepped or erred. This could embolden the IRS to pursue aggressive collection tactics, knowing it can avoid unfavorable rulings by strategically dropping levies. As Gorsuch noted, this leaves taxpayers like Ms. Zuch without recourse to recover funds or contest IRS mistakes.

The ruling also raises questions about fairness in tax enforcement. The IRS has ramped up efforts to target high-income earners and complex tax evasion schemes, leveraging Inflation Reduction Act funding to pursue cases involving unreported foreign accounts and fraudulent credits. While these efforts aim to restore fairness, Gorsuch’s dissent suggests that without judicial oversight, the IRS’s expanded powers could lead to abuses, particularly for individuals caught in bureaucratic errors.

Broader Context: IRS Enforcement and Accountability

The IRS has faced scrutiny for its enforcement practices, particularly in cases involving civil penalties and tax evasion. For example, in Toth v. United States (2023), the IRS imposed a $2.17 million penalty on Monica Toth, an 83-year-old grandmother, for failing to file an FBAR for a Swiss bank account inherited from her father, a Holocaust survivor. Gorsuch’s dissent in that case argued that the penalty was excessive and that the government should not evade Eighth Amendment scrutiny by labeling fines as “civil.” The Zuch ruling amplifies these concerns, suggesting a pattern of judicial deference to IRS actions.

Posts on X reflect public unease, with users like @jbhenchman suggesting legislative fixes, such as amending the Tax Court’s jurisdiction to prevent the IRS from mooting cases. Others, like @JonathanTurley, highlighted Gorsuch’s warning that the IRS can now “avoid accountability by dropping levy claims.” These sentiments underscore a growing perception that the IRS wields disproportionate power, particularly as it expands enforcement campaigns targeting offshore tax evasion and fraudulent claims.

Critical Perspective

While the majority’s ruling aligns with technical legal reasoning—mootness doctrine typically applies when a case’s underlying issue is resolved—Gorsuch’s dissent raises a valid concern about accountability. The IRS’s ability to moot cases by withdrawing levies could create a perverse incentive, allowing the agency to test aggressive strategies without fear of binding precedent. However, critics of Gorsuch’s position might argue that the IRS’s withdrawal of a levy achieves the taxpayer’s immediate goal (halting the levy), and judicial resources should not be spent on hypothetical disputes.

Still, the broader implications are troubling. The IRS’s enforcement campaigns, while targeting high-wealth tax evaders, often sweep up less sophisticated taxpayers, like Toth, who may lack the resources to navigate complex reporting requirements. Without judicial review, such individuals face significant financial and emotional burdens. Gorsuch’s dissent, while rooted in constitutional principle, may overstate the immediate practical impact, as legislative fixes or future cases could address the loophole.

Conclusion

The Supreme Court’s ruling in Commissioner of Internal Revenue v. Zuch marks a significant victory for the IRS, granting it a mechanism to avoid judicial scrutiny by withdrawing levies, as Justice Gorsuch warned in his dissent. This “powerful new tool” could erode taxpayer protections, particularly for those challenging IRS errors or overreach. While the IRS’s push to combat tax evasion is critical, Gorsuch’s critique highlights the need for robust checks on administrative power. As public and legislative scrutiny grows, the Zuch decision may spark calls for reform to ensure the IRS remains accountable to the taxpayers it serves.

This article synthesizes available data, critically examining the Supreme Court’s ruling and Gorsuch’s dissent while avoiding reproduction of copyrighted material.