Alarming Drop: Mortgage Demand Plunges Almost 10% to Shut Out 2025 Regardless of Falling Charges – Patrons Keep Sidelined

Mortgage demand drop hits onerous in early 2026 as mortgage applications decline practically 10%, even with 30-year mortgage charges dipping to 6.25%, signaling persistent warning within the U.S. housing market amid vacation slowdowns and affordability hurdles.

Homebuyers and refinancers hit the brakes heading into the brand new yr. Complete mortgage software quantity tumbled 9.7% for the week ending January 2, 2026, in keeping with the most recent Mortgage Bankers Affiliation (MBA) weekly survey—defying expectations that decrease charges would spark exercise.

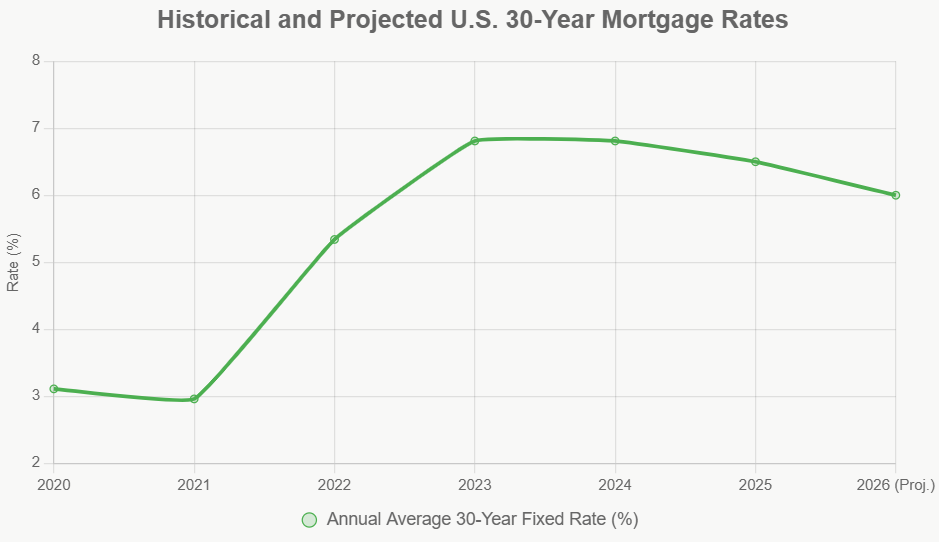

The decline got here regardless of the common 30-year fastened mortgage fee easing to six.25% from 6.32% the prior week—the bottom since September 2024. Refinance functions fell sharply by 15%, whereas buy functions dropped 4%, highlighting a broader pullback.

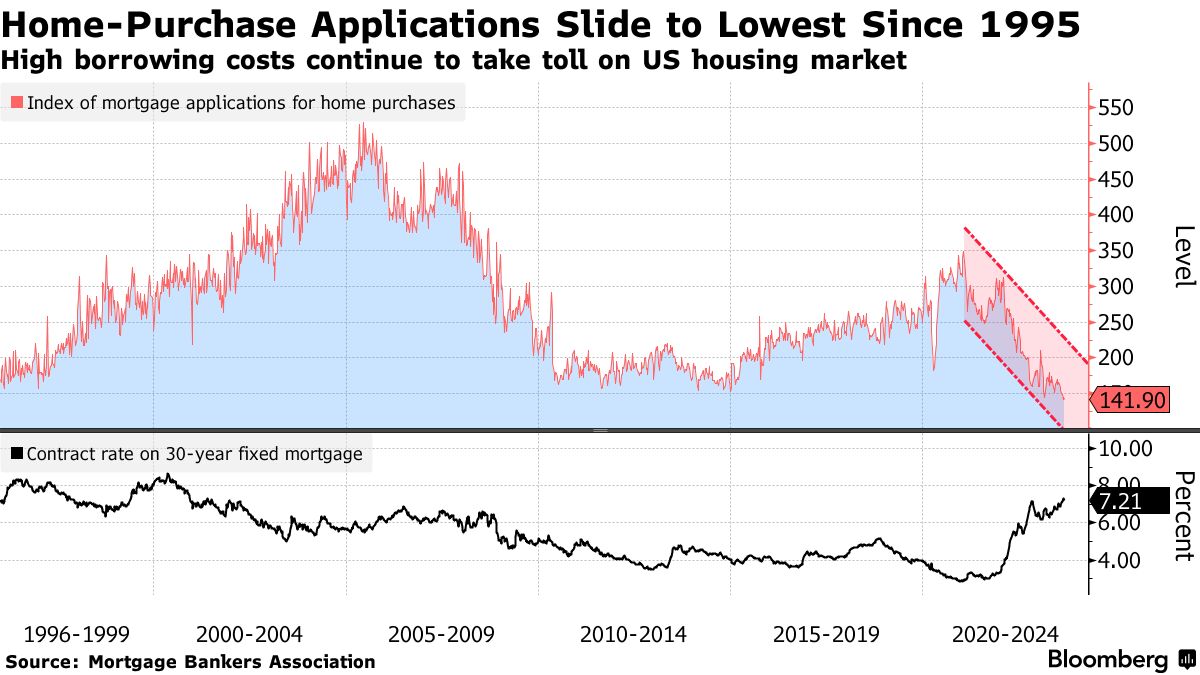

This marks a disappointing finish to 2025, a yr the place charges hovered within the mid-6% vary after peaking above 7% earlier. Seasonal elements performed an enormous function: The survey interval included New Yr’s Day, when many lenders shut or function with decreased workers, resulting in fewer submissions. MBA knowledge will not be seasonally adjusted, amplifying vacation results.

Nonetheless, the unadjusted buy index rose 29% from the holiday-shortened prior week however remained 12% decrease than the identical week in 2024. Refinances, extra rate-sensitive, have been unstable however total subdued as most householders locked in sub-4% charges throughout the pandemic period.

Joel Kan, MBA’s vice chairman and deputy chief economist, famous the dip mirrored “typical year-end slowdowns” however added that decrease charges hadn’t but translated to sustained demand. “Debtors look like ready for even higher circumstances,” he mentioned.

Background exhibits the housing market grappling with affordability challenges. Residence costs stay elevated—up over 40% since 2020—whereas wages have not saved tempo absolutely. Stock has improved barely, however many potential sellers are “locked in” with low-rate mortgages, limiting provide.

Specialists provide combined views. Some see this as momentary, with forecasts from Fannie Mae and others predicting charges averaging round 6.1% to five.9% by late 2026, doubtlessly unlocking extra exercise. Others fear persistent excessive costs might extend the stoop.

Public reactions on social media vary from frustration—”Charges drop a bit and nonetheless nobody bites?”—to optimism for spring shopping for season. Realtors report showings selecting up in some markets, however closings lag.

For U.S. readers, this slowdown impacts a number of areas. Economically, weaker housing demand slows associated sectors like building, furnishings, and home equipment, doubtlessly dragging on GDP progress. Politically, affordability stays a voter concern, influencing coverage debates on taxes and regulation.

Life-style-wise, many aspiring consumers delay goals of homeownership, opting to hire longer amid uncertainty. Households in high-cost areas really feel squeezed, whereas traders eye alternatives in a cooler market.

Expertise performs a task too—on-line fee buying instruments make customers extra rate-sensitive, ready for dips earlier than making use of.

As 2026 begins, eyes flip to approaching MBA studies and Fed actions. If charges stabilize decrease with out vacation distortions, demand might rebound. For now, the drop underscores a market in wait-and-see mode.

The mortgage demand drop in early 2026, with mortgage functions decline practically 10%, displays warning regardless of 30-year mortgage charges at 6.25%, setting the stage for potential shifts within the U.S. housing market as seasonal elements fade.

By Sam Michael

Comply with us on X @realnewshubs and subscribe for push notifications

Comply with and subscribe to us to extend push notifications.