New Jersey Judge Grants Rare Temporary Restraining Order in $430K Cryptocurrency Theft Case

In a landmark ruling, a New Jersey federal judge has granted a rare temporary restraining order (TRO) in a $430,000 cryptocurrency theft case, providing a significant win for victims of digital asset fraud. The case, handled by Newark-based law firm Sullivan & Reed LLP, underscores the judiciary’s increasing willingness to intervene in the rapidly evolving landscape of cryptocurrency-related crimes.

Case Overview

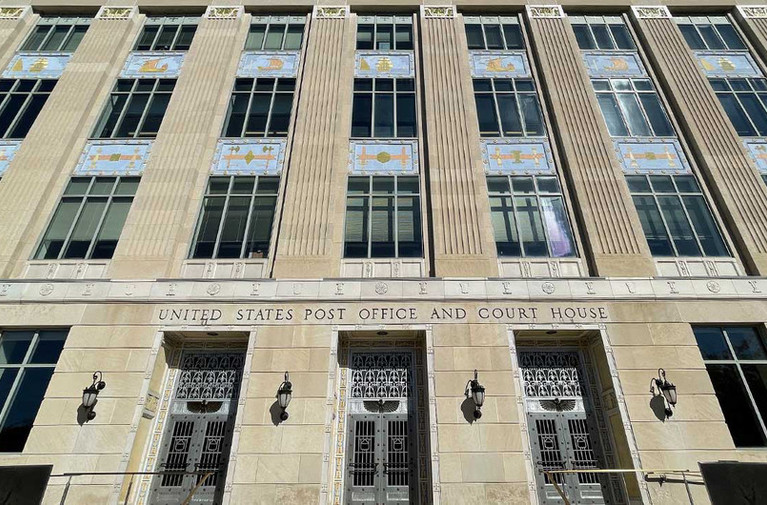

The case centers on a New Jersey resident who lost $430,000 in cryptocurrency, primarily Bitcoin and Tether, to a sophisticated hacking scheme in June 2025. According to court documents, the perpetrators executed a phishing attack to gain access to the victim’s crypto wallet, subsequently transferring the assets to multiple centralized exchanges in an attempt to launder the funds. Sullivan & Reed LLP, leveraging its expertise in cryptocurrency litigation, moved quickly to trace the stolen assets using blockchain forensic tools and filed for a TRO in the U.S. District Court for the District of New Jersey.

On August 20, 2025, U.S. District Judge Claire C. Cecchi issued the TRO, ordering several cryptocurrency exchanges to freeze the accounts suspected of holding the stolen funds. The decision was based on detailed blockchain analysis provided by the firm, which demonstrated the imminent risk of the assets being dissipated or moved offshore. This swift judicial action marks a rare instance of a TRO being granted in a cryptocurrency theft case, given the challenges posed by the decentralized and pseudonymous nature of blockchain transactions.

Legal Strategy and Blockchain Forensics

Sullivan & Reed LLP’s success hinged on its rapid response and collaboration with blockchain forensic experts. The firm traced the stolen cryptocurrency through a series of transactions across the blockchain, identifying key addresses linked to centralized exchanges under U.S. jurisdiction. “Our ability to act within hours of the theft was critical,” said lead attorney Michael Sullivan. “By combining legal expertise with cutting-edge blockchain analysis, we were able to convince the court to act decisively to protect our client’s assets.”

The TRO prevents the exchanges from allowing any withdrawals or transfers from the identified accounts, effectively halting the perpetrators’ attempts to further obscure the funds. This case highlights the growing importance of centralized exchanges in crypto recovery efforts, as they are subject to U.S. anti-money laundering regulations and can be compelled to comply with court orders.

Challenges in Crypto Litigation

Cryptocurrency theft cases are notoriously difficult to litigate due to the speed of transactions and the anonymity provided by blockchain technology. Perpetrators often use techniques like “mixing” or “peel chains” to obscure the trail of stolen funds, making recovery efforts complex. The Department of Justice has noted a rise in such cases, with recent actions including the seizure of over $2.8 million in cryptocurrency linked to fraud schemes and a $225.3 million forfeiture action against crypto investment scams.

Sullivan & Reed LLP’s ability to secure a TRO in this case demonstrates the potential for legal remedies when firms act quickly and leverage advanced technology. “The key is to intervene before the funds are moved to non-custodial wallets or jurisdictions beyond our reach,” Sullivan explained.

Broader Implications for Crypto Fraud Victims

The ruling sets an important precedent for cryptocurrency theft victims, signaling that courts are becoming more adept at addressing digital asset fraud. According to the 2025 Legal Trends Report by Clio, 36% of law firms are now using AI and blockchain analysis tools to tackle complex cases, a trend that is particularly relevant in crypto litigation. This case also aligns with recent enforcement actions in New Jersey, where authorities have cracked down on crypto-related crimes, including a $600,000 fraud scheme targeting first responders and a $500,000 theft involving SIM-swapping.

“This TRO is a beacon of hope for victims of crypto theft,” said blockchain consultant Rachel Lee, who assisted in the case. “It shows that with the right legal and technical approach, recovery is possible even in the complex world of cryptocurrency.”

Next Steps in the Case

With the TRO in place, Sullivan & Reed LLP is pursuing a permanent injunction to secure the return of the frozen assets to the victim. The firm is also working with federal authorities, including the FBI’s National Cryptocurrency Enforcement Team, to identify the perpetrators. A hearing is scheduled for October 2025 to determine the final disposition of the funds. In the meantime, the frozen accounts remain under court oversight, preventing further movement of the stolen cryptocurrency.

A Growing Role for Specialized Firms

The success of Sullivan & Reed LLP in this case highlights the rising demand for law firms with expertise in cryptocurrency and blockchain technology. As digital assets become more prevalent, firms that combine legal acumen with technical proficiency are well-positioned to lead in this niche area. The case also underscores the importance of centralized exchanges in combating crypto fraud, as their compliance with court orders can be pivotal in recovery efforts.

For victims of cryptocurrency theft, this ruling offers a roadmap for pursuing justice. By acting swiftly and leveraging blockchain forensics, law firms can help clients recover assets that might otherwise be lost forever. As the legal system continues to adapt to the challenges of digital finance, cases like this one demonstrate that the courts are ready to protect victims in the rapidly evolving world of cryptocurrency.

Sources: U.S. District Court for the District of New Jersey, Department of Justice, Clio’s 2025 Legal Trends Report