Nvidia Faces Rising Competitors from Huawei in China’s AI Chip Market

Beijing, Could 17, 2025 – Nvidia, the U.S.-based chip large, is grappling with mounting challenges in sustaining its foothold in China’s profitable AI chip market, as native tech powerhouse Huawei intensifies competitors. U.S. sanctions and a surge in demand for home options have put Nvidia’s enterprise in China—as soon as a big contributor to its income—beneath strain, with Huawei’s Ascend collection chips gaining traction.

A Shifting Panorama

China has traditionally accounted for 17-25% of Nvidia’s income, however U.S. export controls imposed since 2022 have restricted the corporate from promoting its most superior AI chips, such because the H100 and B100, within the area. In response, Nvidia developed China-specific chips just like the H20, L20, and L2, designed to adjust to U.S. restrictions. Nonetheless, these chips have confronted weak demand, with Reuters reporting an oversupply forcing Nvidia to promote the H20 at a ten% low cost in comparison with Huawei’s Ascend 910B, China’s strongest AI chip.

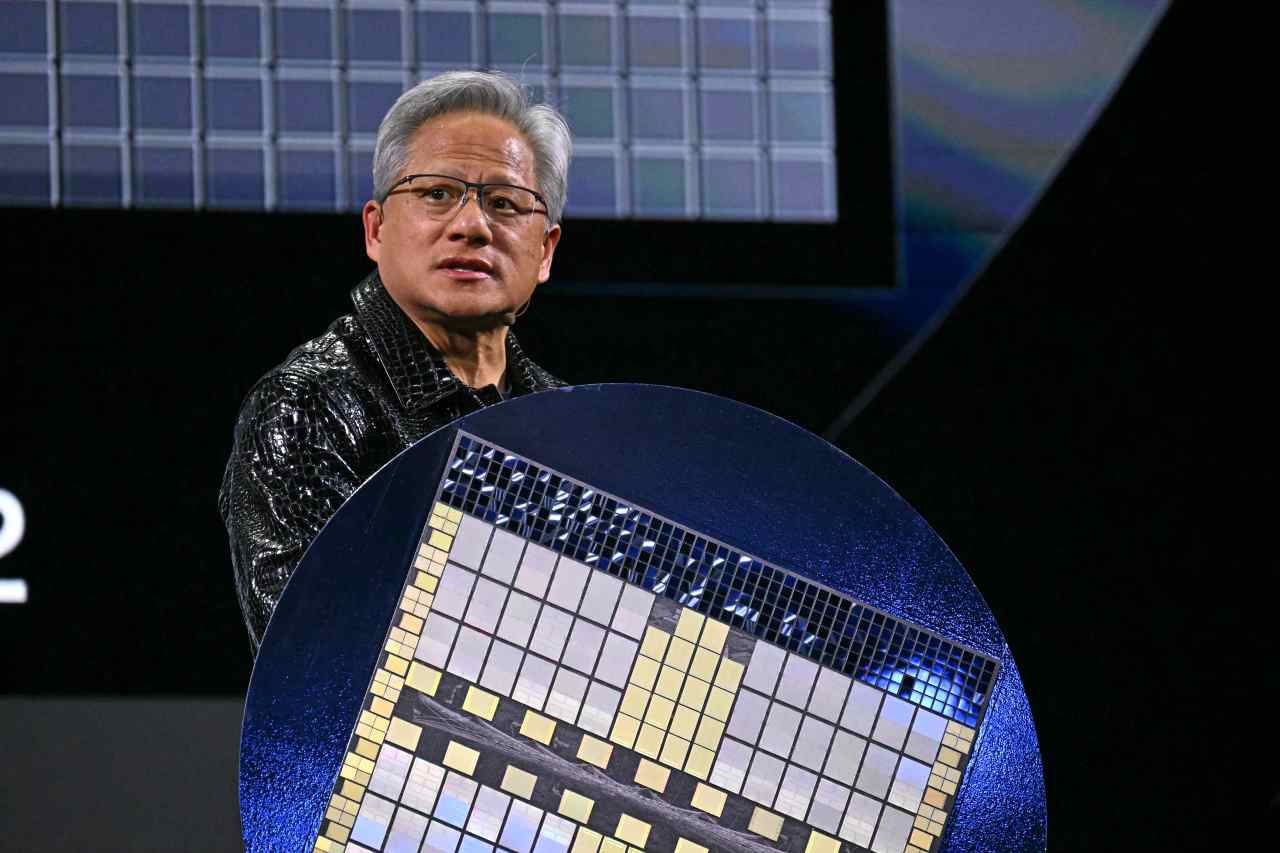

Nvidia’s CEO, Jensen Huang, acknowledged the aggressive strain, stating, “There’s a good quantity of competitors in China. Huawei and different firms are fairly vigorous and really, very aggressive.” The corporate’s knowledge middle income in China has dropped considerably, with CFO Colette Kress noting it now represents solely a “mid-single-digit proportion” of complete knowledge middle gross sales.

Huawei’s Rise Amid Sanctions

Huawei, regardless of dealing with U.S. sanctions since 2019 that restrict its entry to superior chip-making know-how, has made vital strides in growing its Ascend AI chip collection. The Ascend 910B, which competes instantly with Nvidia’s A100, has been reported to outperform the H20 in key metrics, in response to business sources. Huawei’s newest Ascend 910C, set for mass shipments in June 2025, is claimed to rival Nvidia’s H100 by combining two 910B processors for enhanced computing energy and reminiscence capability.

Huawei’s progress is bolstered by China’s push for technological self-sufficiency. Beijing’s directives encouraging firms to prioritize home chips have pushed demand for Huawei’s choices, with over a dozen state-affiliated patrons expressing curiosity within the Ascend 910B in comparison with simply 5 for Nvidia’s H20 in latest months. Main Chinese language tech companies like Alibaba and Baidu have additionally proven a desire for Huawei’s chips, with Alibaba reportedly ordering over 30,000 H20 chips however leaning towards home options for future wants.

Challenges for Nvidia

Nvidia’s struggles in China are compounded by a number of elements. The H20, whereas Nvidia’s strongest China-compliant chip, is much less aggressive as a result of its decreased efficiency in comparison with banned fashions just like the H100. Analysts notice that the H20’s greater manufacturing prices, pushed by elevated reminiscence capability, power Nvidia to promote it at a cheaper price than the H100, eroding margins. Moreover, U.S. export controls tightened in April 2025 now require licenses for H20 gross sales, additional limiting Nvidia’s market entry.

Posts on X mirror rising sentiment that Huawei’s developments threaten Nvidia’s dominance, with some claiming Huawei’s Ascend chips are closing the efficiency hole. One consumer famous, “Huawei constructed the precise chips they have been banned from shopping for,” highlighting the corporate’s capability to ship 800,000 items in months, matching Nvidia’s energy in some respects.

Huawei’s Broader Ambitions

Huawei’s resurgence extendsbeyond chips. The corporate’s 2023 Mate 60 Professional smartphone, powered by a domestically produced chip, demonstrated its capability to realize 5G-like speeds regardless of U.S. restrictions. The Mate 70 collection, launched in 2024 with Huawei’s self-developed HarmonyOS NEXT, additional solidified its push for independence from Western know-how. Huawei’s income surged 22% in 2024 to $118.27 billion, signaling a strong restoration from a 29% drop in 2021 brought on by sanctions.

Huawei can be testing its Ascend 910D, which goals to surpass Nvidia’s H100 in energy effectivity utilizing superior packaging strategies. The corporate plans to ship over 800,000 Ascend 910B and 910C chips in 2025, concentrating on main shoppers like ByteDance and state-owned telecoms.

What Lies Forward

Nvidia is trying to adapt, with experiences suggesting it’s tweaking the H20’s design to navigate export restrictions. Nonetheless, analysts warn that China’s AI chip market, projected to exceed 30% of the worldwide business by 2035, is more and more favoring native gamers like Huawei and Cambricon Applied sciences, whose shares have soared over 400% prior to now yr.

The U.S.-China tech rivalry continues to form the market, with some arguing that export controls have inadvertently strengthened Huawei by pushing China towards self-reliance. As one analyst famous, “If there have been no export controls, Nvidia would have nearly the entire GPU enterprise in China right this moment.” With Huawei’s fast developments and China’s rising home chip ecosystem, Nvidia faces an uphill battle to retain its once-dominant place on this planet’s largest semiconductor market.

By Priya Malhotra, Know-how Correspondent