Lagos, Nigeria, May 5, 2025 — Parallex Bank Limited, Nigeria’s pioneering commercial bank that transitioned from a microfinance institution, has launched its highly anticipated Parallex Mobile App 2.1, boasting over 200 new features designed to redefine financial freedom for its customers. Announced on May 2, 2025, via the bank’s official X account (@parallexbankng), the upgraded app aims to deliver unparalleled convenience, security, and control, positioning Parallex as a leader in Nigeria’s competitive digital banking landscape.

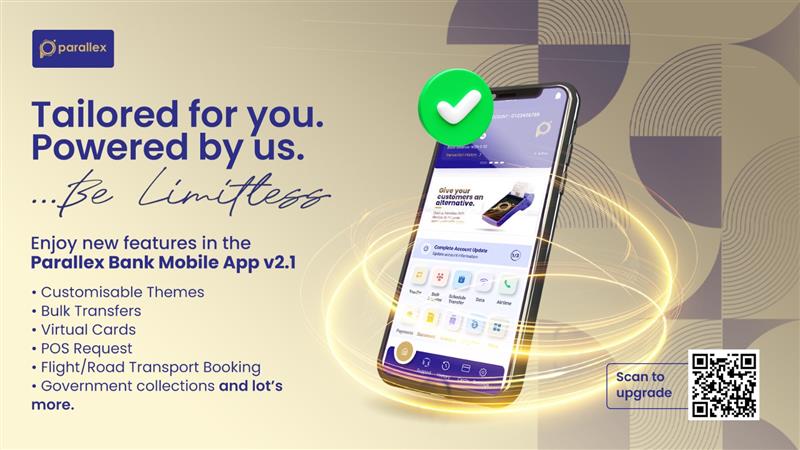

The Parallex Mobile App 2.1, available on iOS App Store and Google Play, builds on the success of its 2.0 version launched in February 2024, which introduced seamless account opening, debit card management, and free daily transfers. The latest iteration, described as “bigger, bolder, and built just for you,” integrates advanced functionalities to cater to diverse banking and lifestyle needs. Key features highlighted in posts on X include bulk transfers, virtual card creation, flight and transport booking, fast loan applications, and POS machine requests, all accessible from a user-friendly interface.

Dr. Olufemi Bakre, Managing Director of Parallex Bank, emphasized the app’s role in empowering customers. “Our vision is to be the preferred financial solution provider, and App 2.1 delivers on that promise with over 200 innovative features that give users greater flexibility and control over their finances,” he stated. The app supports instant account opening with referral code options, biometric login, transaction PIN resets, and the ability to toggle account balance visibility for enhanced security. It also facilitates NQR merchant payments, eNaira deposits and withdrawals, and bill payments for utilities, airtime, and data.

Additional standout features include scheduled transfers, account upgrade requests, and the ability to enable or disable debit cards remotely, ensuring robust user control. The app’s travel-centric offerings, such as flight bookings, align with modern lifestyle demands, while its loan application process promises rapid approvals to support financial goals. Posts on X, including one from @tola_cashout, praised these capabilities, stating, “Fast loans. Flight bookings. Full control. Parallex Bank App V2.1 delivers.”

Parallex Bank, which made history as the first Nigerian bank to transition from a microfinance to a commercial bank in January 2021, has leveraged technology to disrupt traditional banking. Its commitment to innovation earned it the Reputable Bank of the Year award from the Global Reputation Forum in December 2023. The bank’s expansion, including plans for 12 new branches in 2023 and partnerships like the Lagos State government’s athlete payment solutions in August 2024, underscores its growth trajectory.

However, the rollout has not been without challenges. Some users reported issues with the app crashing on Android 10.0 devices after the April 29, 2025, update, prompting Parallex to advise clearing cache or reinstalling the app. The bank’s customer service team, reachable at customercare@parallexbank.com, has been responsive to these concerns, ensuring support for affected users.

With its extensive feature set, Parallex Mobile App 2.1 positions the bank to compete with fintech giants while maintaining its customer-centric ethos. As @SleekStineszn noted on X, “The upgraded Parallex Bank App V2.1 is live. Schedule transfers, request POS machines, get loans—all in one place.” The app’s launch reinforces Parallex’s mission to provide limitless banking, empowering Nigerians to manage their finances with ease and efficiency.

Download Parallex Mobile App 2.1 from parallexbank.com, iOS App Store, or Google Play, and follow @parallexbankng on X for updates.