A Texas district court has issued an emergency freeze order on millions of dollars linked to a cryptocurrency fraud scheme that targeted a Georgia medical professional, marking one of the latest cases in a growing wave of crypto-related financial crimes sweeping across the United States. The Georgian doctor lost substantial funds after being lured into what appeared to be a legitimate digital asset investment opportunity, only to discover the operation was an elaborate scam designed to drain victims’ bank accounts.

Doctor Loses Life Savings in Elaborate Crypto Scheme

According to court documents filed in the Western District of Texas, the unnamed Georgia physician was approached through social media platforms with promises of extraordinary returns on cryptocurrency investments. The scammers presented themselves as licensed financial advisors specializing in Bitcoin and Ethereum trading, complete with fabricated credentials and professional-looking websites that mimicked legitimate investment firms.

The victim initially invested a modest amount, which appeared to generate profits on a fake trading dashboard. Encouraged by these false returns, the doctor transferred increasingly larger sums over several months, eventually losing approximately $2.3 million in retirement savings and personal assets. The cryptocurrency was immediately converted and moved through multiple digital wallets, making traditional recovery methods nearly impossible.

Court Takes Swift Action to Protect Assets

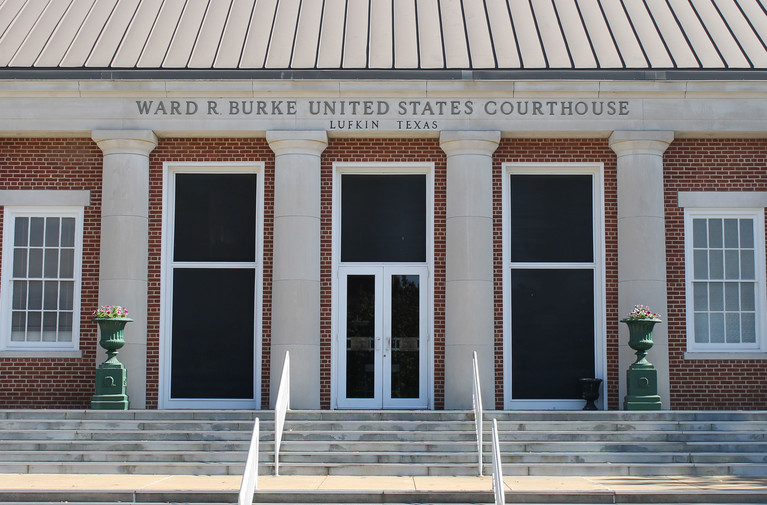

U.S. District Judge Robert Pitman granted the temporary restraining order after federal prosecutors presented evidence linking the frozen funds to the fraudulent operation. The court’s decisive action came after investigators traced portions of the stolen cryptocurrency to bank accounts in Texas, where the funds had been converted to traditional currency.

“This type of financial predation has become alarmingly common,” said cryptocurrency security analyst Jennifer Martinez from the Blockchain Security Institute. “Scammers are becoming increasingly sophisticated, using psychological manipulation tactics combined with technical complexity to confuse even educated professionals.”

The Federal Trade Commission reports that Americans lost over $5.6 billion to cryptocurrency scams in 2023 alone, representing a 45% increase from the previous year. Medical professionals, attorneys, and other high-income earners have become prime targets due to their substantial savings and often limited knowledge of digital currency markets.

How the Scam Operated

Investigators revealed that the criminal operation used a multi-layered approach to build trust with victims. The scammers created elaborate fake investment platforms that displayed real-time market data alongside fabricated account balances showing impressive gains. Victims could see their supposed profits growing daily, which encouraged them to invest even more money.

The fraudsters also employed “recovery agents” who would contact victims after they realized they’d been scammed, offering to help retrieve lost funds for an upfront fee. This secondary scam victimized people who had already lost everything, extracting additional thousands of dollars before disappearing.

Texas has emerged as a significant hub for cryptocurrency activity in the United States, attracting both legitimate blockchain businesses and criminal operations. The state’s favorable regulatory environment for digital assets has made it an attractive location for crypto enterprises, but it has also drawn bad actors looking to exploit the growing market.

Warning Signs Americans Should Watch For

Financial experts urge U.S. consumers to recognize common red flags associated with cryptocurrency investment scams. These include unsolicited contact through social media, promises of guaranteed high returns, pressure to invest quickly, requests to send cryptocurrency to unfamiliar wallet addresses, and platforms that prevent withdrawals without additional payments.

The Securities and Exchange Commission has issued multiple investor alerts warning that legitimate investment opportunities never guarantee profits, especially in the volatile cryptocurrency market. Anyone claiming they can consistently beat market returns through secret trading strategies or insider information is almost certainly running a scam.

Law enforcement agencies across the United States are increasingly coordinating efforts to combat cryptocurrency fraud, but the borderless nature of digital currencies makes prosecution challenging. The Georgia doctor’s case represents a rare success story where authorities managed to identify and freeze assets before they disappeared completely offshore.

Financial Impact on American Families

The psychological and financial devastation caused by these scams extends far beyond the immediate monetary loss. Many victims face bankruptcy, foreclosure, and destroyed retirement plans. The Georgia physician’s case highlights how even intelligent, successful professionals can fall victim to sophisticated social engineering tactics combined with the complexity of cryptocurrency technology.

Consumer protection advocates are calling for stronger regulations in the cryptocurrency industry, including mandatory verification processes for trading platforms and clearer disclosures about the risks of digital asset investments. However, the decentralized nature of cryptocurrency makes traditional regulatory approaches difficult to implement effectively.

As the court proceedings continue, federal authorities are working to identify additional victims and recover more stolen assets. The case serves as a stark reminder that cryptocurrency investment scams represent one of the fastest-growing financial crimes targeting American consumers, with losses expected to climb even higher in 2025 as digital currency adoption continues expanding across the United States.

Americans interested in legitimate cryptocurrency investments should only use well-established, regulated exchanges, never send crypto to unknown wallet addresses, verify all investment opportunities through official regulatory databases, and remember that if returns seem too good to be true, they almost certainly are in the cryptocurrency fraud landscape.Written by Mark Smith

Follow us and subscribe to stay updated on breaking financial crime news, cryptocurrency security alerts, and consumer protection updates. Enable push notifications to never miss critical warnings that could protect your finances.